2020 U S Individual Income Tax Returns Deadline Extended By Irs

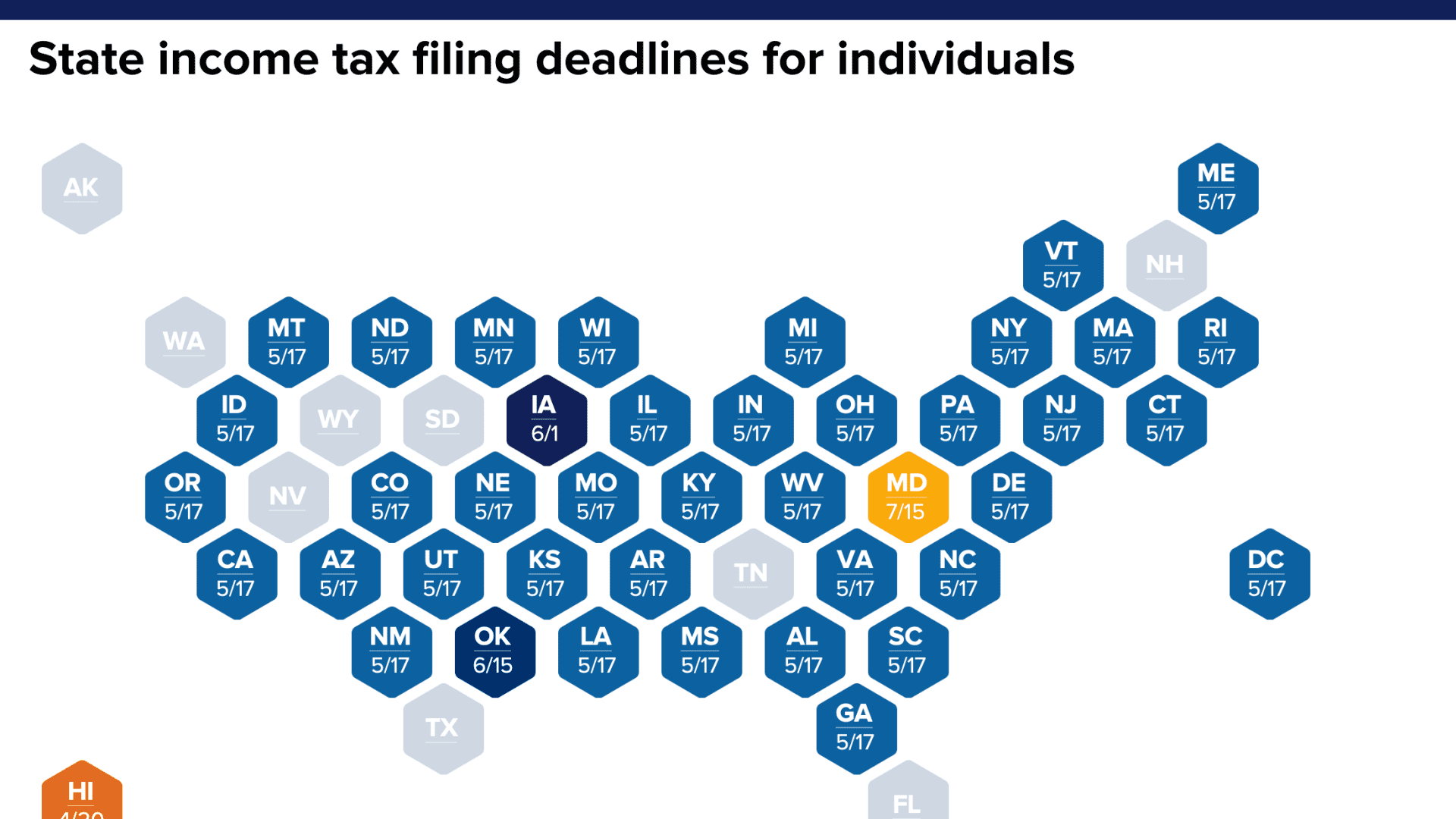

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due October 15 is the filing extension deadline. most taxpayers who requested an extension of time to file their 2020 tax return must file tomorrow to avoid the penalty for filing late. extension filers who owe taxes should pay as much as possible to reduce interest and penalties. Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on april 15, 2021, to may 17, 2021, without penalties and interest, regardless of the amount owed. this postponement applies to individual taxpayers, including individuals who pay self employment tax.

2020 U S Individual Income Tax Returns Deadline Extended By Irs Washington — the u.s. department of the treasury and the internal revenue service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from april 15, 2021, to may 17, 2021. On march 17, 2021, the irs announced that it was extending, from april 15, 2021 to may 17, 2021, the deadline for filing a 2020 federal individual income tax return and the deadline for paying 2020 federal individual income tax. Taxpayers have until july 15, 2020 to make estimated income tax payments for 2020 that otherwise would have been due on april 15, 2020. the extension is available for all types of taxpayers, including individuals, trusts, estates, corporations, and any type of unincorporated entity. Washington – the internal revenue service today announced that individuals have until may 17, 2021 to meet certain deadlines that would normally fall on april 15, such as making ira contributions and filing certain claims for refund.

Tax News Irs Extends 2020 Individual Federal Income Tax Deadline Taxpayers have until july 15, 2020 to make estimated income tax payments for 2020 that otherwise would have been due on april 15, 2020. the extension is available for all types of taxpayers, including individuals, trusts, estates, corporations, and any type of unincorporated entity. Washington – the internal revenue service today announced that individuals have until may 17, 2021 to meet certain deadlines that would normally fall on april 15, such as making ira contributions and filing certain claims for refund. The internal revenue service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from april 15, 2021, to may 17, 2021. the irs will be providing formal guidance in the coming days. The official extension request, via irs form 4868, will provide an additional 5 months for you to file your 2020 federal tax return (through october 15, 2021), but will not extend the payment due date beyond may 17, 2021. Individual taxpayers who need additional time to file beyond the july 15 deadline can request an extension to oct. 15, 2020, by filing form 4868 through their tax professional, tax software or using the free file link on irs.gov. businesses who need additional time must file form 7004. The irs has moved the deadline for filing 2020 federal income tax returns from april 15 to may 17, 2021.

Comments are closed.