Analyzing Financial Market Trends In R Geeksforgeeks

Analyzing Financial Market Trends In R Geeksforgeeks Analyzing financial market trends in r this plot provides a visual tool for analyzing the performance and trends of google stock over time, making it easier to identify patterns and make informed decisions. For instance, we can easily download and analyze financial market data using the quantmod (quantitative financial modelling framework) r package.

Premium Photo Analyzing Financial Market Trends Whether you’re a seasoned investor or enterprising day trader, you need to be using the quantmod package in r for all your quantitative financial research and statistical analysis! this tutorial will provide an overview of the package and highlight the most important functions. Financial market analysis tools developed using r programming language for statistical computing and data analysis. this project showcases advanced r programming skills, statistical modeling expertise, and professional data science methodologies. For this project, we are going to explore some of the common technical indicators using the general electric stock. ge data is extracted using the getsymbols function from yahoo finance. alternatively, the source can be replaced with fred, mysql, google, or others. Whether you’re analyzing stock prices, forecasting financial trends, or calculating risk, r offers a wide range of tools to simplify these tasks. this article will explore how r programming can be effectively used to analyze financial data.

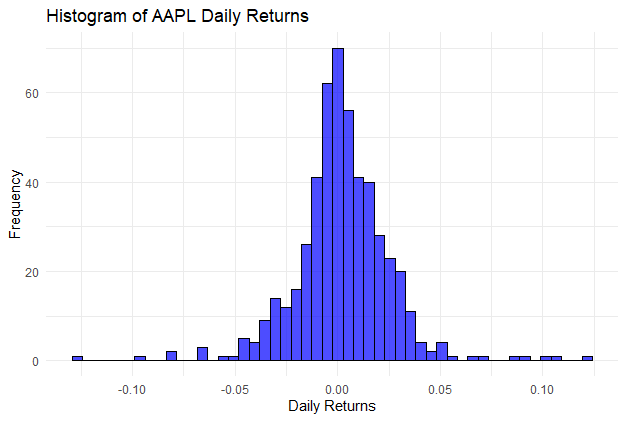

Analyzing Financial Market Trends In R Geeksforgeeks For this project, we are going to explore some of the common technical indicators using the general electric stock. ge data is extracted using the getsymbols function from yahoo finance. alternatively, the source can be replaced with fred, mysql, google, or others. Whether you’re analyzing stock prices, forecasting financial trends, or calculating risk, r offers a wide range of tools to simplify these tasks. this article will explore how r programming can be effectively used to analyze financial data. Through this series of posts, we are primarily examining the stock market, its dynamics, cycles, valuation metrics, as well as the pre ipo and startup ecosystem, the bond market, real estate, and even a touch of crypto. Trend analysis in r programming language is widely used across various fields, including finance, economics, environmental science, epidemiology, and market research, among others. in trend analysis, the hypothesis testing framework is often used to formally test whether a trend exists in the data. Finance using pandas, visualizing stock data, moving averages, developing a moving average crossover strategy, backtesting, and benchmarking. the final post will include practice problems. this first post discusses topics up to introducing moving averages. Exploring and simulating financial data is a crucial first step in statistical analysis. this phase focuses on understanding the distribution of data, identifying interdependencies, and preparing datasets for more advanced modeling.

Comments are closed.