Chapter 11 With Problems Accounting Studocu

Chapter 11 Problems Final Answers Pdf Interest On studocu you find all the lecture notes, summaries and study guides you need to pass your exams with better grades. Preview text franchise accounting 177 chapter 11 multiple choice answers and solutions b no revenue is to be reported.

Chapter 11 Financial Accounting Accn08011 Studocu Accounting depreciation is defined as an accounting process of allocating the costs of tangible assets to expense in a systematic and rational manner to the periods expected to benefit from the use of the asset. Chapter 11 (with problems) university: adamson university course:financial accounting and reporting (ac108) 156documents students shared 156 documents in this course info more info download. Explain the accounting for bond transactions. when companies issue bonds, they debit cash for the cash proceeds and credit bonds payable for the face value of the bonds. The problems cover topics such as true false statements about reciprocal account balances, journal entries, and calculations involving sales, inventory, and cost of goods sold between a home office and branch.

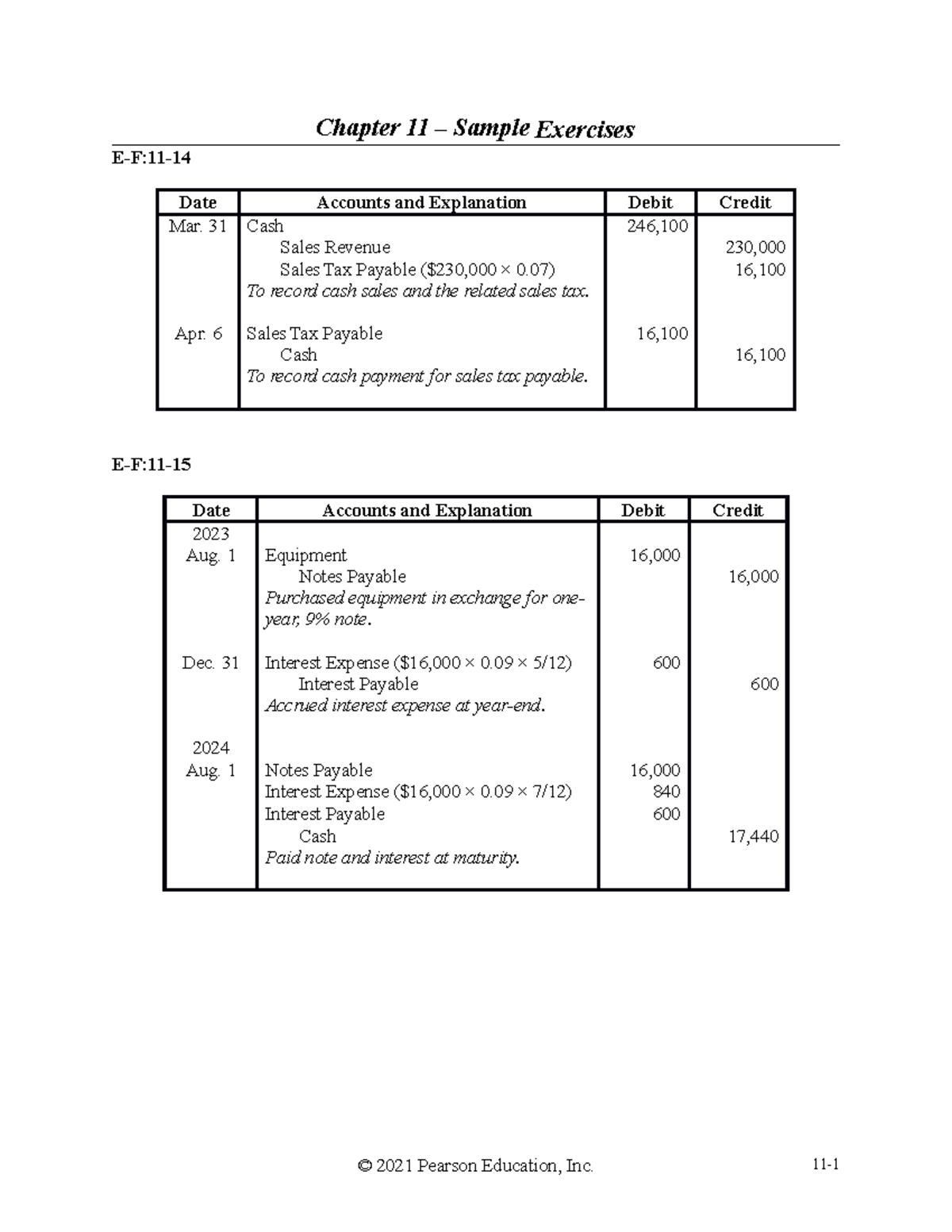

Chapter 11 Sample Exercises Docx Chapter 11 Sample Exercises E F 11 Date Accounts And Explain the accounting for bond transactions. when companies issue bonds, they debit cash for the cash proceeds and credit bonds payable for the face value of the bonds. The problems cover topics such as true false statements about reciprocal account balances, journal entries, and calculations involving sales, inventory, and cost of goods sold between a home office and branch. Explain the accounting issues related to asset impairment. 7. explain how to report and analyze property, plant, and equipment and natural resources. 1. depreciation is a means of cost allocation, not a matter of valuation. 5. the three factors involved in the depreciation process are the depreciation base, the. This is a premium document. some documents on studocu are premium. upgrade to premium to unlock it. Has custody of the corporations funds and maintains the company's cash operations. corporations must pay federal and state income taxes as a separate legal entity. corporate income is taxed twice (double taxation) once at the corporate level and again at the individual level. Accounting entries are made on may 1 (debit cash dividends and credit dividends payable), and on may 31 (debit dividends payable and credit cash). a cash dividend decreases assets, retained earnings, and total equity.

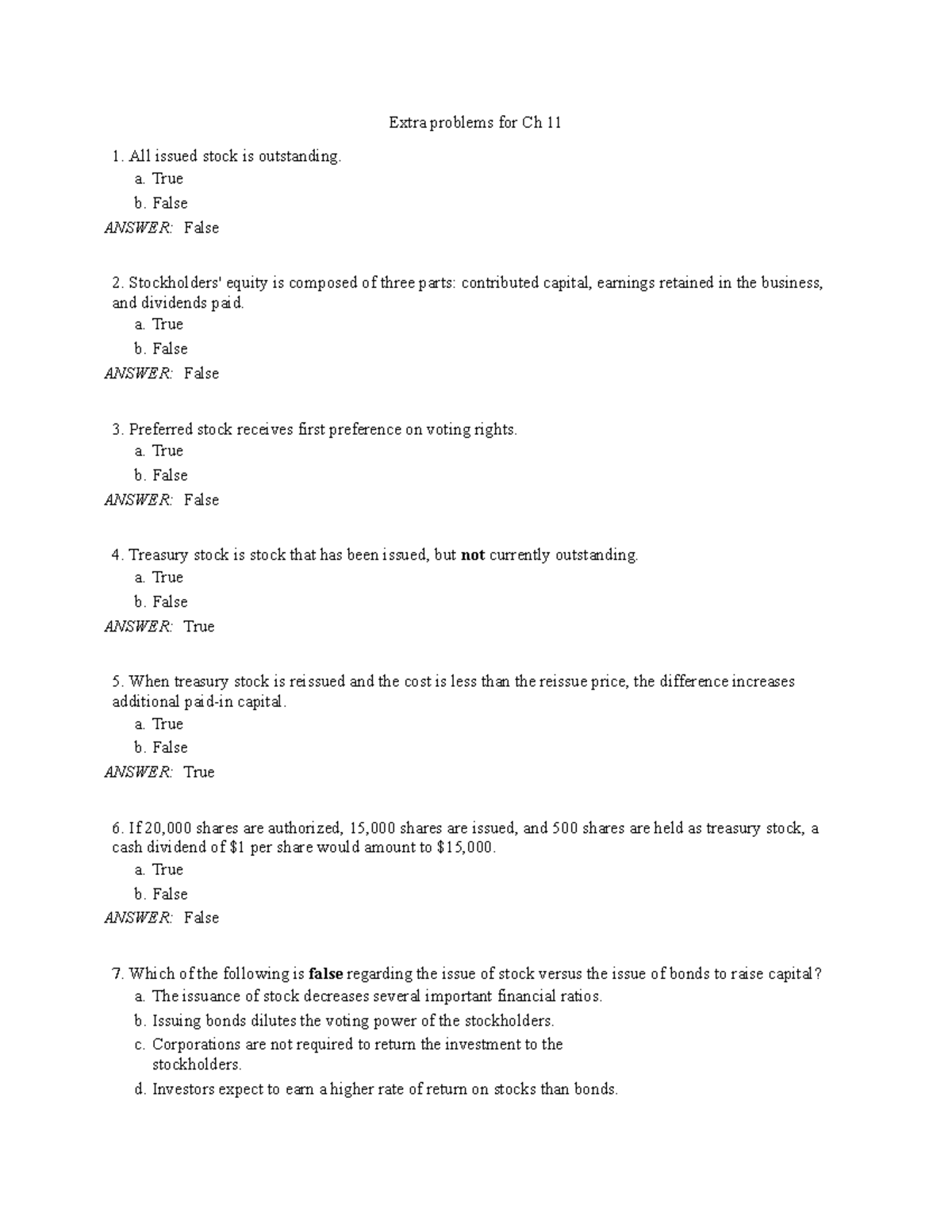

Extra Problems For Ch 11 Acct 229 Extra Problems For Ch 11 All Issued Stock Is Outstanding A Explain the accounting issues related to asset impairment. 7. explain how to report and analyze property, plant, and equipment and natural resources. 1. depreciation is a means of cost allocation, not a matter of valuation. 5. the three factors involved in the depreciation process are the depreciation base, the. This is a premium document. some documents on studocu are premium. upgrade to premium to unlock it. Has custody of the corporations funds and maintains the company's cash operations. corporations must pay federal and state income taxes as a separate legal entity. corporate income is taxed twice (double taxation) once at the corporate level and again at the individual level. Accounting entries are made on may 1 (debit cash dividends and credit dividends payable), and on may 31 (debit dividends payable and credit cash). a cash dividend decreases assets, retained earnings, and total equity.

Chapter 11 With Problems Accounting Studocu Has custody of the corporations funds and maintains the company's cash operations. corporations must pay federal and state income taxes as a separate legal entity. corporate income is taxed twice (double taxation) once at the corporate level and again at the individual level. Accounting entries are made on may 1 (debit cash dividends and credit dividends payable), and on may 31 (debit dividends payable and credit cash). a cash dividend decreases assets, retained earnings, and total equity.

Comments are closed.