Corporate Law 4 Pdf Loans Equity Finance

09 - Equity PDF | PDF | Equity (Law) | Trust Law

09 - Equity PDF | PDF | Equity (Law) | Trust Law This document discusses various aspects of share capital, including defining share capital, distinguishing between share/equity capital and loan/debt capital, minimum share capital requirements, circumstances when shares may be offered for issue, and regulations around non cash consideration issues. There are numerous ways to finance a corporation’s activities, each with different risk and reward profiles for the corporation and its investors. here, we will briefly discuss the most common financing instruments and their legal implications under united states and similar legal systems.

Corporate Law | PDF

Corporate Law | PDF It provides an in depth look at the broad and often complex issues related to the classification, measurement, presentation and disclosure of financing instruments. and it includes examples demonstrating how to apply the standards to some common financing transactions. An overview of corporate governance is presented along with a framework for understanding and analyzing corporate governance and stakeholder management. the growing impact of environmental and social considerations in invest ing is also highlighted. Other methods of corporate finance include bank financing and bonds. we also discuss some more modern financing methods, such as private equity and venture capital. If, during the term of a loan, there is a corporate action in relation to loaned securities or collateral, the lender or borrower (as appropriate) is normally entitled to specify at that time the form in which he wishes to receive equivalent securities or collateral on termination of the loan.

Equity Laws | PDF | Mortgage Law | Equity (Law)

Equity Laws | PDF | Mortgage Law | Equity (Law) Other methods of corporate finance include bank financing and bonds. we also discuss some more modern financing methods, such as private equity and venture capital. If, during the term of a loan, there is a corporate action in relation to loaned securities or collateral, the lender or borrower (as appropriate) is normally entitled to specify at that time the form in which he wishes to receive equivalent securities or collateral on termination of the loan. Section 4 discusses beta estimation, a key input in using the capm to calculate the cost of equity, and section 5 examines the correct treatment of flotation, or capital issuance, costs. The us cma syllabus covers corporate finance sources under corporate finance and financial decision making. cma candidates examine financing sources like long term debt, equity capital, venture capital, and retained earnings. In addition to the cases, statutes, and textual materials, i have included excerpts from various corporate finance documents, such as debentures, trust indentures, preferred stock provisions, and acquisition agreements. This page discusses primary sources for raising corporate funds: plowback (reinvesting earnings), debt securities (loans via bonds), equity securities (ownership through stock), and private equity/venture capital (investments from private investors).

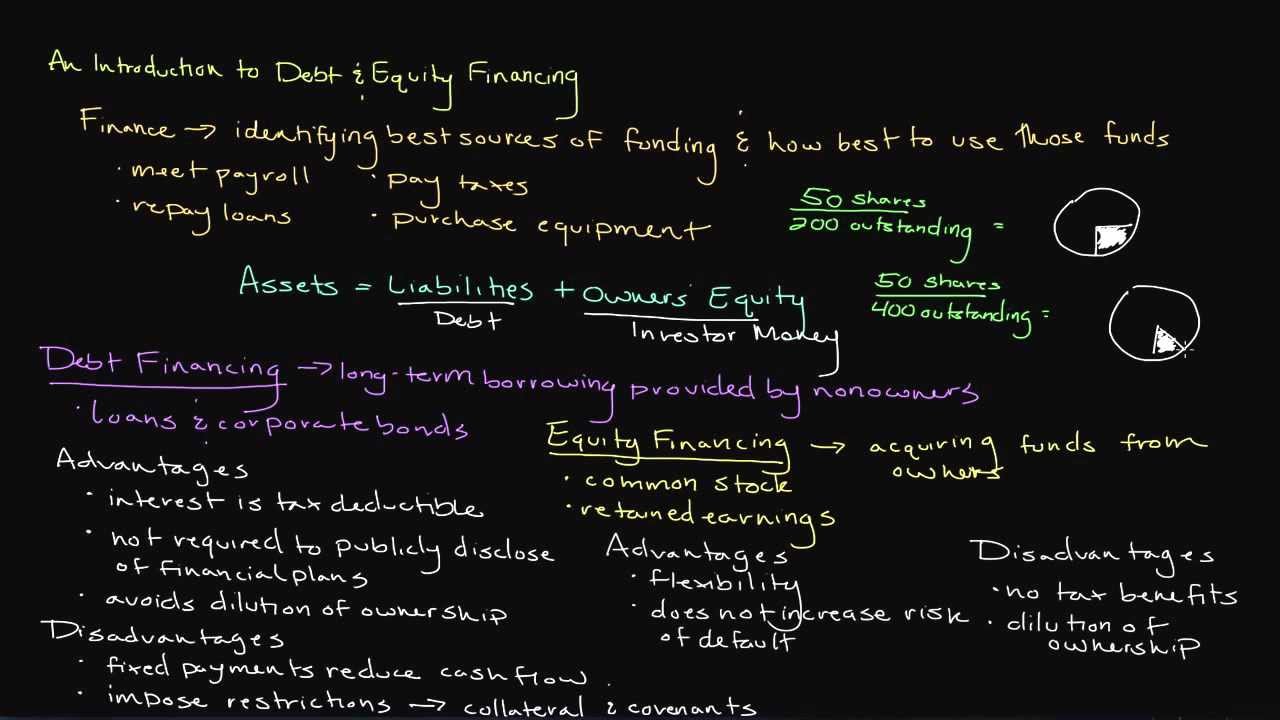

Introduction to Debt and Equity Financing

Introduction to Debt and Equity Financing

Related image with corporate law 4 pdf loans equity finance

Related image with corporate law 4 pdf loans equity finance

About "Corporate Law 4 Pdf Loans Equity Finance"

Comments are closed.