Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator | Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator | Double Entry Bookkeeping Use this calculator to calculate the accelerated depreciation by double declining balance method or 200% depreciation. create and print full depreciation schedules. This calculator will calculate the rate and expense amount for an asset for a given year based on its acquisition cost, salvage value, and expected useful life using the double declining balance method.

Declining Balance Depreciation Schedule Calculator | Double Entry Bookkeeping

Declining Balance Depreciation Schedule Calculator | Double Entry Bookkeeping The double declining balance method (ddb) describes an approach to accounting for the depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life. After inputting all of the information, the double declining depreciation calculator will automatically generate the book value year start, depreciation percent, depreciation expense, accumulated depreciation, and the book value year end for four years. Use the double declining balance calculator to quickly compute asset depreciation. get accurate ddb values by year with ease. A double declining depreciation calculator helps businesses and individuals determine the depreciation expense of an asset using the double declining balance method.

Double Declining Balance Depreciation Template | PDF

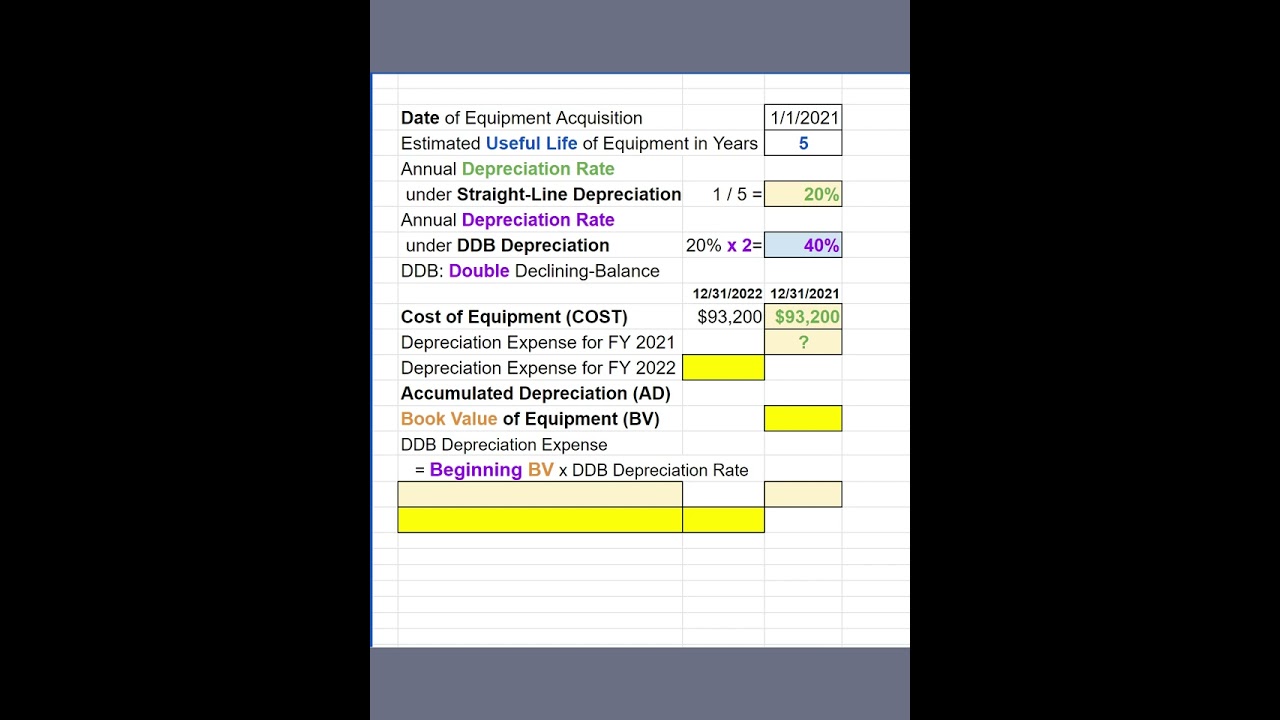

Double Declining Balance Depreciation Template | PDF Use the double declining balance calculator to quickly compute asset depreciation. get accurate ddb values by year with ease. A double declining depreciation calculator helps businesses and individuals determine the depreciation expense of an asset using the double declining balance method. The double declining depreciation calculator is a helpful tool designed to calculate depreciation based on the double declining balance method. it allows you to input the asset’s initial cost, residual value, and its useful life to calculate the annual depreciation expense. A video explaining double declining balance method of depreciating an asset. in the subsequent years of the asset, the same percentage is applied to the beginning net book value of the asset. Calculate asset depreciation using different methods including straight line, declining balance, sum of years, and macrs with our free online depreciation calculator.

Depreciation Archives | Page 2 Of 3 | Double Entry Bookkeeping

Depreciation Archives | Page 2 Of 3 | Double Entry Bookkeeping The double declining depreciation calculator is a helpful tool designed to calculate depreciation based on the double declining balance method. it allows you to input the asset’s initial cost, residual value, and its useful life to calculate the annual depreciation expense. A video explaining double declining balance method of depreciating an asset. in the subsequent years of the asset, the same percentage is applied to the beginning net book value of the asset. Calculate asset depreciation using different methods including straight line, declining balance, sum of years, and macrs with our free online depreciation calculator.

Reducing Balance Depreciation Calculation Double Entry Bookkeeping | The Best Porn Website

Reducing Balance Depreciation Calculation Double Entry Bookkeeping | The Best Porn Website Calculate asset depreciation using different methods including straight line, declining balance, sum of years, and macrs with our free online depreciation calculator.

Double Declining-Balance Depreciation: Example 1, 101

Double Declining-Balance Depreciation: Example 1, 101

Related image with declining balance depreciation schedule calculator double entry bookkeeping

Related image with declining balance depreciation schedule calculator double entry bookkeeping

About "Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping"

Comments are closed.