Dollar Cost Averaging Dca Explained For Beginners

Dca Or Dollar Cost Averaging Explained For Beginners By dollar-cost averaging, or making a consistent investment of $50 each month, you would have ended up with 6461 shares That’s near the middle point between buying low and buying high Dollar-cost averaging (DCA) bitcoin in an automated manner has emerged as a popular way to “stack sats” among Bitcoiners Por Unchained Atualizado 8 de mar de 2024, 7:49 pm Publicado 11 de

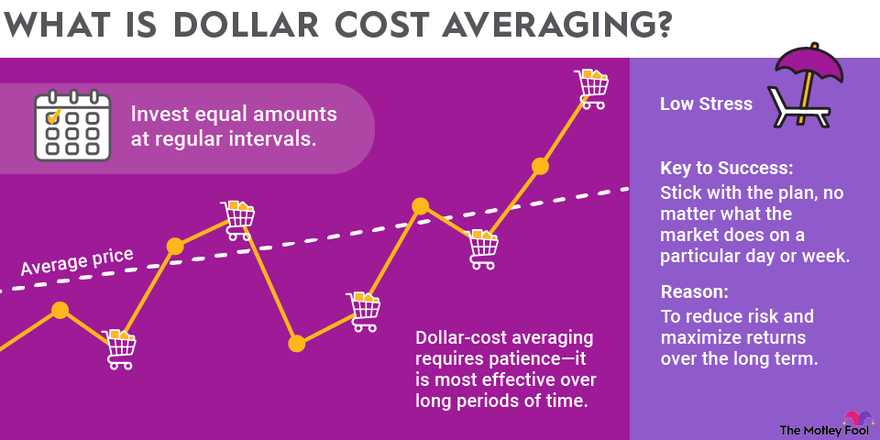

Dollar Cost Averaging Dca Explained With Examples And 44 Off Learn how dollar-cost averaging works in 2025, its benefits, potential drawbacks, and how to get started with this straightforward investing strategy Business Insider Subscribe Newsletters With dollar-cost averaging, an investor buys a fixed dollar amount of a position at regular time intervals—say, on the first of each month—because it allows you to buy more shares when the Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk Over the long term, dollar cost averaging can help lower your investment costs and In both scenarios, dollar-cost averaging provides better outcomes: At $60 per share Dollar-cost averaging delivers a $6,900 gain, compared to a $2,400 gain with the lump sum approach

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk Over the long term, dollar cost averaging can help lower your investment costs and In both scenarios, dollar-cost averaging provides better outcomes: At $60 per share Dollar-cost averaging delivers a $6,900 gain, compared to a $2,400 gain with the lump sum approach Dollar-cost averaging can help mitigate risk when you're investing in an ETF or index fund that tracks the S&P 500 But there are caveats to keep in mind Also, dollar cost averaging (DCA), which entails putting new money to work gradually over time, can take the emotions out of the equation When the stock market tanks as it did back in April, By dollar-cost averaging, or making a consistent investment of $50 each month, you would have ended up with 6461 shares That’s near the middle point between buying low and buying high

Dca Dollar Cost Averaging Investment Strategy Explained D Petkovski Dollar-cost averaging can help mitigate risk when you're investing in an ETF or index fund that tracks the S&P 500 But there are caveats to keep in mind Also, dollar cost averaging (DCA), which entails putting new money to work gradually over time, can take the emotions out of the equation When the stock market tanks as it did back in April, By dollar-cost averaging, or making a consistent investment of $50 each month, you would have ended up with 6461 shares That’s near the middle point between buying low and buying high

Dollar Cost Averaging Dca Explained Tap Global By dollar-cost averaging, or making a consistent investment of $50 each month, you would have ended up with 6461 shares That’s near the middle point between buying low and buying high

Comments are closed.