Dollar Cost Averaging Dca Explained With Examples And 44 Off

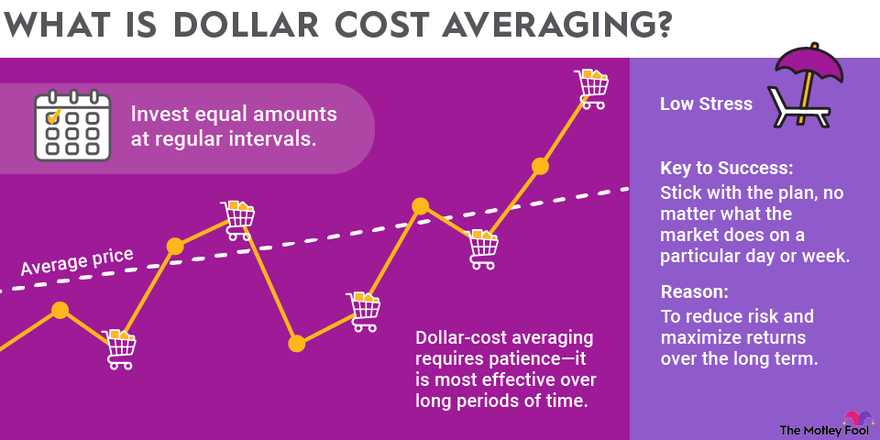

Dollar Cost Averaging Dca Explained With Examples And Off Sexiezpix Web Porn Dollar cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. by using dollar cost averaging,. Dollar cost averaging is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a security. dollar cost averaging can reduce the overall impact of price volatility and lower the average cost per share.

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging (dca) presents a straightforward and beginner friendly approach to investing. in this article, we will delve into the definition of dollar cost averaging and explain what it is, how it works, and why it can be an effective investment strategy. Dollar cost averaging (dca) is an investment strategy where rather than investing all the available capital at once, incremental investments are gradually made over time. how does dollar cost averaging work?. Dollar cost averaging is an investment strategy that divides the total amount to be invested across regular purchases of a target asset at consistent intervals, regardless of fluctuations in the asset's price. it allows investors to spread out investments instead of buying a large sum upfront. • dollar cost averaging (dca) is an investment strategy that helps manage volatility by investing a fixed dollar amount regularly. • dca involves buying securities at regular intervals, regardless of market prices, to avoid trying to time the market.

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging is an investment strategy that divides the total amount to be invested across regular purchases of a target asset at consistent intervals, regardless of fluctuations in the asset's price. it allows investors to spread out investments instead of buying a large sum upfront. • dollar cost averaging (dca) is an investment strategy that helps manage volatility by investing a fixed dollar amount regularly. • dca involves buying securities at regular intervals, regardless of market prices, to avoid trying to time the market. What is dollar cost averaging? dollar cost averaging (dca) is an investment strategy when individuals invest a fixed amount at regular intervals into the same stocks, mutual funds, or etfs (exchange traded funds). no matter what the financial markets are doing, the dollar amount never varies. Dollar cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. want to know if this strategy's right for you? it's helpful to understand the math. here's a hypothetical example say you decide to invest using a dollar cost averaging strategy. At its core, dollar cost averaging is an investment strategy where you regularly invest a fixed amount of money into a particular asset, regardless of its current price. Dollar cost averaging is a strategy of investing a defined dollar amount at consistent intervals over time. in theory, it is an investment strategy that lowers the average cost of a security and decreases the potential risk of market volatility.

Dollar Cost Averaging Explained With Examples Dollar Cost Average What is dollar cost averaging? dollar cost averaging (dca) is an investment strategy when individuals invest a fixed amount at regular intervals into the same stocks, mutual funds, or etfs (exchange traded funds). no matter what the financial markets are doing, the dollar amount never varies. Dollar cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. want to know if this strategy's right for you? it's helpful to understand the math. here's a hypothetical example say you decide to invest using a dollar cost averaging strategy. At its core, dollar cost averaging is an investment strategy where you regularly invest a fixed amount of money into a particular asset, regardless of its current price. Dollar cost averaging is a strategy of investing a defined dollar amount at consistent intervals over time. in theory, it is an investment strategy that lowers the average cost of a security and decreases the potential risk of market volatility.

Dollar Cost Averaging Explained With Examples Dollar Cost Average At its core, dollar cost averaging is an investment strategy where you regularly invest a fixed amount of money into a particular asset, regardless of its current price. Dollar cost averaging is a strategy of investing a defined dollar amount at consistent intervals over time. in theory, it is an investment strategy that lowers the average cost of a security and decreases the potential risk of market volatility.

Dollar Cost Averaging Explained With Examples Dollar Cost Average

Comments are closed.