Dollar Cost Averaging Dca In Crypto Explained What Is It And How

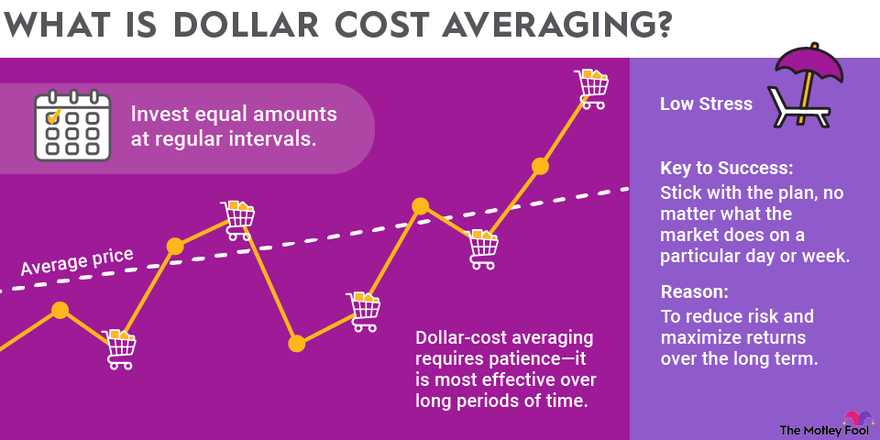

Crypto Dca Explained How Dollar Cost Averaging Works Stopsaving Dollar cost averaging (dca) is a strategy that seeks to reduce the impact of market volatility on large acquisitions of financial assets such as equities or cryptocurrencies. it involves allocating a fixed amount of resources to a particular asset at regular intervals, regardless of its price. In this educational article, we’ll understand a specific crypto trading strategy: dollar cost averaging (dca). this strategy can be particularly suited for new investors since it doesn’t require much time and adopts inherent strategies of risk management, reducing some risks.

Dollar Cost Averaging Dca In Crypto Explained What Is It And How Does It Work What is dollar cost averaging (dca) and how does it work? to lessen the impact of volatility on the overall purchase, investors use the dollar cost averaging (dca) investment technique to. You may have heard of dollar cost averaging as a popular investment strategy. but what is it, and is it sound? learn more in this dca guide. Dollar cost averaging (dca) offers a systematic and disciplined approach to navigating these challenges, allowing investors to build a crypto portfolio over time without the stress of market timing. this article explores how dca works, its benefits, risks, and best practices to help you make informed decisions in your crypto investments. Dollar cost averaging (dca) is an effective long term investment strategy to minimize risk, secure profits, and steadily grow your crypto portfolio over time. learn how to leverage dca to earn a profit despite crypto market volatility.

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging (dca) offers a systematic and disciplined approach to navigating these challenges, allowing investors to build a crypto portfolio over time without the stress of market timing. this article explores how dca works, its benefits, risks, and best practices to help you make informed decisions in your crypto investments. Dollar cost averaging (dca) is an effective long term investment strategy to minimize risk, secure profits, and steadily grow your crypto portfolio over time. learn how to leverage dca to earn a profit despite crypto market volatility. Dollar cost averaging (dca) involves investing fixed amounts of money into a crypto asset at regular intervals. dca is popular among some crypto investors because it works to minimise the impact of volatility on the price of an asset. Key takeaways dollar cost averaging is an investment strategy where you invest a fixed amount of money into crypto at regular intervals regardless of market price. dca helps reduce the emotional stress of market timing and is especially effective in volatile markets like crypto. unlike lump sum investing, dca spreads your purchases over time, smoothing out entry prices and lowering the risk of. Dollar cost averaging is a proven investment strategy that helps reduce the risks associated with volatile markets like cryptocurrency. by consistently investing a fixed amount over time, dca lowers the impact of market fluctuations and removes the need for market timing. Dollar cost averaging allows investors to reduce the risk of timing their purchases by spreading out their entry points instead of spending a lump sum all at once. what’s the benefit of this strategy? when you dca crypto, you actively offset the negative impacts that occur as a result of short term market volatility.

Dollar Cost Averaging Dca In Crypto Explained Dollar cost averaging (dca) involves investing fixed amounts of money into a crypto asset at regular intervals. dca is popular among some crypto investors because it works to minimise the impact of volatility on the price of an asset. Key takeaways dollar cost averaging is an investment strategy where you invest a fixed amount of money into crypto at regular intervals regardless of market price. dca helps reduce the emotional stress of market timing and is especially effective in volatile markets like crypto. unlike lump sum investing, dca spreads your purchases over time, smoothing out entry prices and lowering the risk of. Dollar cost averaging is a proven investment strategy that helps reduce the risks associated with volatile markets like cryptocurrency. by consistently investing a fixed amount over time, dca lowers the impact of market fluctuations and removes the need for market timing. Dollar cost averaging allows investors to reduce the risk of timing their purchases by spreading out their entry points instead of spending a lump sum all at once. what’s the benefit of this strategy? when you dca crypto, you actively offset the negative impacts that occur as a result of short term market volatility.

Dollar Cost Averaging Dca In Crypto Explained Dollar cost averaging is a proven investment strategy that helps reduce the risks associated with volatile markets like cryptocurrency. by consistently investing a fixed amount over time, dca lowers the impact of market fluctuations and removes the need for market timing. Dollar cost averaging allows investors to reduce the risk of timing their purchases by spreading out their entry points instead of spending a lump sum all at once. what’s the benefit of this strategy? when you dca crypto, you actively offset the negative impacts that occur as a result of short term market volatility.

Dollar Cost Averaging In Crypto Explained

Comments are closed.