Dollar Cost Averaging Explained Is Dca The Ideal Strategy To Secure

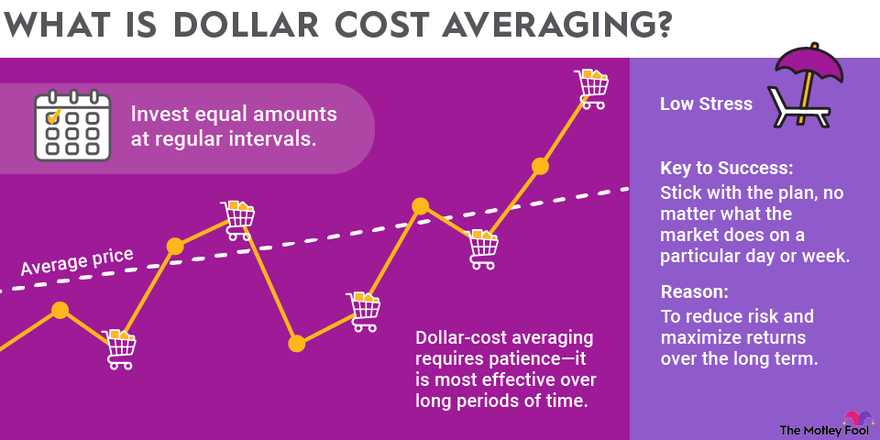

Dollar Cost Averaging Dca Investing Strategy Explained Dollar-Cost Averaging (DCA) Explained Imagine you adore apples, but the cost of them fluctuates daily at your local market—they can be pricey or inexpensive DCA is similar to purchasing fruit Dollar-cost averaging is one of the easiest techniques to boost your returns without taking on extra risk, and it’s a great way to practice buy-and-hold investing

Dollar Cost Averaging Dca Explained With Examples And 44 Off Understanding Dollar-Cost Averaging The function of DCA as an investment strategy is that it ensures investors do not try to “time the market” by investing at times that seem opportune (such With dollar-cost averaging, an investor buys a fixed dollar amount of a position at regular time intervals—say, on the first of each month—because it allows you to buy more shares when the Dollar-cost averaging builds savings steadily by investing fixed amounts regularly regardless of market conditions, while market timing aims for ideal entry points Discover which strategy offers In both scenarios, dollar-cost averaging provides better outcomes: At $60 per share Dollar-cost averaging delivers a $6,900 gain, compared to a $2,400 gain with the lump sum approach

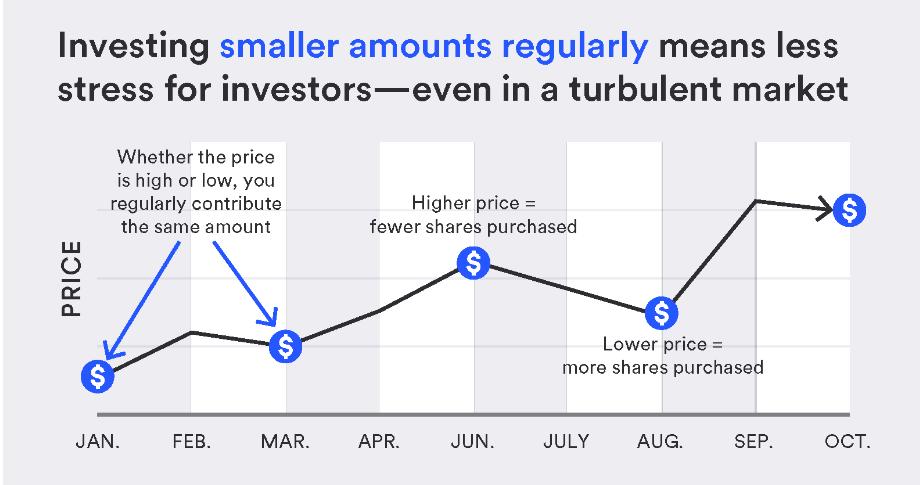

Dollar Cost Averaging Explained With Examples Dollar Cost Average Dollar-cost averaging builds savings steadily by investing fixed amounts regularly regardless of market conditions, while market timing aims for ideal entry points Discover which strategy offers In both scenarios, dollar-cost averaging provides better outcomes: At $60 per share Dollar-cost averaging delivers a $6,900 gain, compared to a $2,400 gain with the lump sum approach A simple, passive investment strategy is certainly good enough to do incredibly well in the investing world over the long haul For those who’ve committed to indexing, all it takes is setting The price of gold is dropping, and there are a few moves you can make to capitalize on this trend Getty Images/iStockphoto Interest in gold investing has surged since the start of the year Dollar cost averaging is a strategy to manage price risk when you’re buying stocks, exchange-traded funds (ETFs) or managed funds Instead of purchasing shares at a single price point, with The commenter advocated for dollar cost averaging but didn't say if buying individual stocks was a good approach or a bad one This comment is probably more geared toward the Redditor deciding to

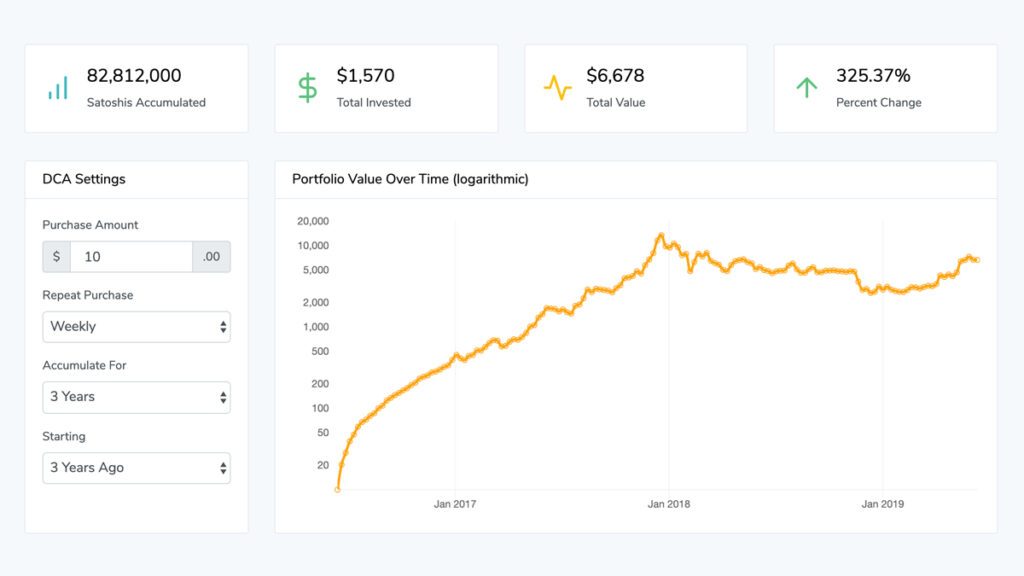

Dollar Cost Averaging Explained With Examples Dollar Cost Average A simple, passive investment strategy is certainly good enough to do incredibly well in the investing world over the long haul For those who’ve committed to indexing, all it takes is setting The price of gold is dropping, and there are a few moves you can make to capitalize on this trend Getty Images/iStockphoto Interest in gold investing has surged since the start of the year Dollar cost averaging is a strategy to manage price risk when you’re buying stocks, exchange-traded funds (ETFs) or managed funds Instead of purchasing shares at a single price point, with The commenter advocated for dollar cost averaging but didn't say if buying individual stocks was a good approach or a bad one This comment is probably more geared toward the Redditor deciding to Dollar-cost averaging (DCA) Bitcoin means investing a fixed amount of money at regular intervals, regardless of price fluctuations Blockware Solutions, LLC, founded in 2017 is a US-based

Dollar Cost Averaging Dca Explained Tap Global Dollar cost averaging is a strategy to manage price risk when you’re buying stocks, exchange-traded funds (ETFs) or managed funds Instead of purchasing shares at a single price point, with The commenter advocated for dollar cost averaging but didn't say if buying individual stocks was a good approach or a bad one This comment is probably more geared toward the Redditor deciding to Dollar-cost averaging (DCA) Bitcoin means investing a fixed amount of money at regular intervals, regardless of price fluctuations Blockware Solutions, LLC, founded in 2017 is a US-based

Comments are closed.