Dollar Cost Averaging In The Stock Market To Maximize Profits

Maximize Your Investments Dollar Cost Averaging Allgen Financial Advisors Inc Dollar cost averaging is an investment strategy that divides the total investment amount across periodic purchases, reducing risks from lump sum investments and capitalizing on market price variations. Dollar cost averaging is a sound way to invest in the stock market. follow a sound strategy over the long term and watch your wealth grow.

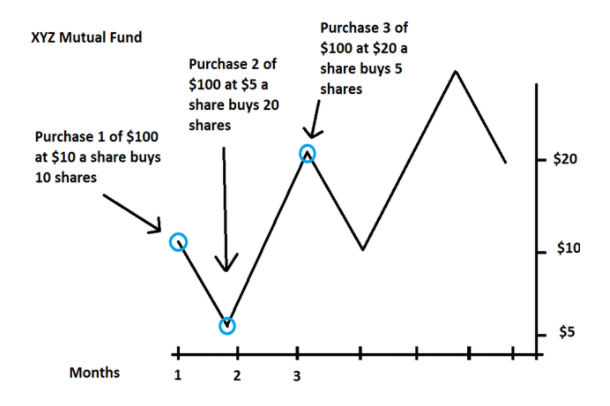

Maximize Your Investments Dollar Cost Averaging Allgen Financial Advisors Inc Dollar cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. by using dollar cost averaging,. Dollar cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. What is dollar cost averaging? when you use the dollar cost averaging strategy, you invest the same amount into an asset at regular intervals. Dollar cost averaging (dca) is an investment strategy where rather than investing all the available capital at once, incremental investments are gradually made over time. how does dollar cost averaging work?.

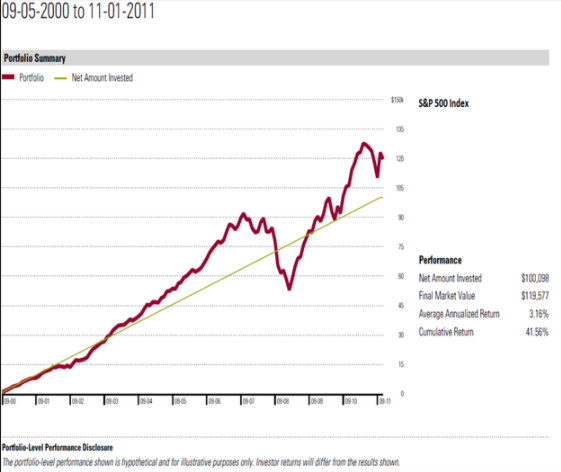

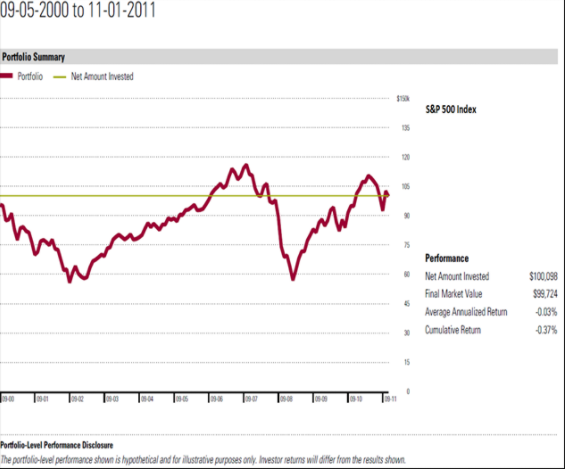

Maximize Your Investments Dollar Cost Averaging Allgen Financial Advisors Inc What is dollar cost averaging? when you use the dollar cost averaging strategy, you invest the same amount into an asset at regular intervals. Dollar cost averaging (dca) is an investment strategy where rather than investing all the available capital at once, incremental investments are gradually made over time. how does dollar cost averaging work?. Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. it's a good way to develop a disciplined investing habit, be more efficient in how you invest, and potentially lower your stress level—as well as your average cost per share. Dollar cost averaging is an investment strategy that divides the total amount to be invested across regular purchases of a target asset at consistent intervals, regardless of fluctuations in the asset's price. it allows investors to spread out investments instead of buying a large sum upfront. By staying consistent, dollar cost averaging helps to reduce the impact of short term market fluctuations on your overall investment strategy, making it a great tool for risk averse investors. dollar cost averaging may not guarantee quick profits, but it excels in building wealth over the long term. the key is patience and consistency. Learn what dca is and how dollar cost averaging works. discover its benefits, drawbacks, and who should use dca investing. explore an example and avoid common mistakes with this proven strategy.

Maximize Your Investments Dollar Cost Averaging Allgen Financial Advisors Inc Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. it's a good way to develop a disciplined investing habit, be more efficient in how you invest, and potentially lower your stress level—as well as your average cost per share. Dollar cost averaging is an investment strategy that divides the total amount to be invested across regular purchases of a target asset at consistent intervals, regardless of fluctuations in the asset's price. it allows investors to spread out investments instead of buying a large sum upfront. By staying consistent, dollar cost averaging helps to reduce the impact of short term market fluctuations on your overall investment strategy, making it a great tool for risk averse investors. dollar cost averaging may not guarantee quick profits, but it excels in building wealth over the long term. the key is patience and consistency. Learn what dca is and how dollar cost averaging works. discover its benefits, drawbacks, and who should use dca investing. explore an example and avoid common mistakes with this proven strategy.

Comments are closed.