Exempted Income Income Exempted From Tax In India Income Tax Ppt Easy Explanation

Income Tax In India PowerPoint And Google Slides Template

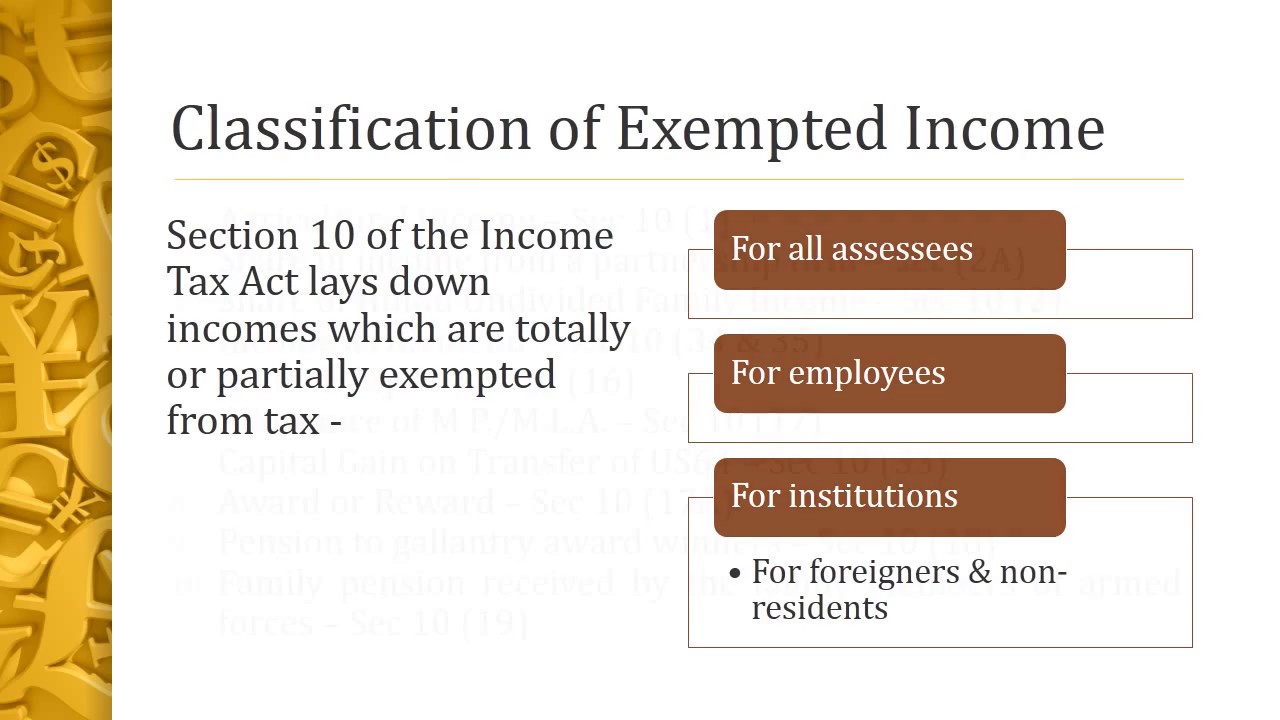

Income Tax In India PowerPoint And Google Slides Template The document discusses various types of income that are exempt from income tax under the income tax act in india. Exempt income refers to specific types of income that are not taxable under the provisions of the income tax act. in india, section 10 of the income tax act of 1961 governs exempt income, which qualifies for non taxability if it adheres to specific guidelines and conditions.

Presentation On Income Exempted From Income Tax | PDF | Partnership | Tax Exemption

Presentation On Income Exempted From Income Tax | PDF | Partnership | Tax Exemption The legal provisions of exempted income under income tax is dealt with the section 10 of the income tax act, 1961. each clause under this section details specific income which is exempt and the necessary conditions for exemption. The document discusses various types of income that are exempted from taxation under section 10 of india's income tax act. When it comes to income tax in india, understanding what you don’t have to pay tax on can be just as important as knowing what you do. the indian income tax act provides several exemptions specifically designed to benefit individuals, particularly salaried employees. The income of an individual is a sum of various components. the indian income tax department has kept some of these components partially or completely exempted from the taxable income. continue reading to know the types of exempted income in income tax and how to avail it.

Income Tax PPT 4 | PDF | Tax Rate | Taxable Income

Income Tax PPT 4 | PDF | Tax Rate | Taxable Income When it comes to income tax in india, understanding what you don’t have to pay tax on can be just as important as knowing what you do. the indian income tax act provides several exemptions specifically designed to benefit individuals, particularly salaried employees. The income of an individual is a sum of various components. the indian income tax department has kept some of these components partially or completely exempted from the taxable income. continue reading to know the types of exempted income in income tax and how to avail it. The document lists over 50 types of income that are exempted from income tax in india under various sections of the indian income tax act of 1961. Exempt income is defined as any income that is not subject to income tax. according to section 10 of the income tax act of 1961, some types of income are subject to income tax within a financial year if they meet certain criteria and circumstances. Exempted income in income tax in india learn which incomes are exempt from tax but mandatory to report in itr. 3. classification of exempted incomes such as those absolutely exempt for all assessees, employees, and institutions. detailed lists and explanations of exempted incomes are provided for each classification. download as a pdf, pptx or view online for free.

Exempted Income | INCOME EXEMPTED FROM TAX IN INDIA| Income Tax ppt (Easy Explanation)

Exempted Income | INCOME EXEMPTED FROM TAX IN INDIA| Income Tax ppt (Easy Explanation)

Related image with exempted income income exempted from tax in india income tax ppt easy explanation

Related image with exempted income income exempted from tax in india income tax ppt easy explanation

About "Exempted Income Income Exempted From Tax In India Income Tax Ppt Easy Explanation"

Comments are closed.