Fin 300 Lecture Notes Chapter 2 Financial Statements Taxes And Cash

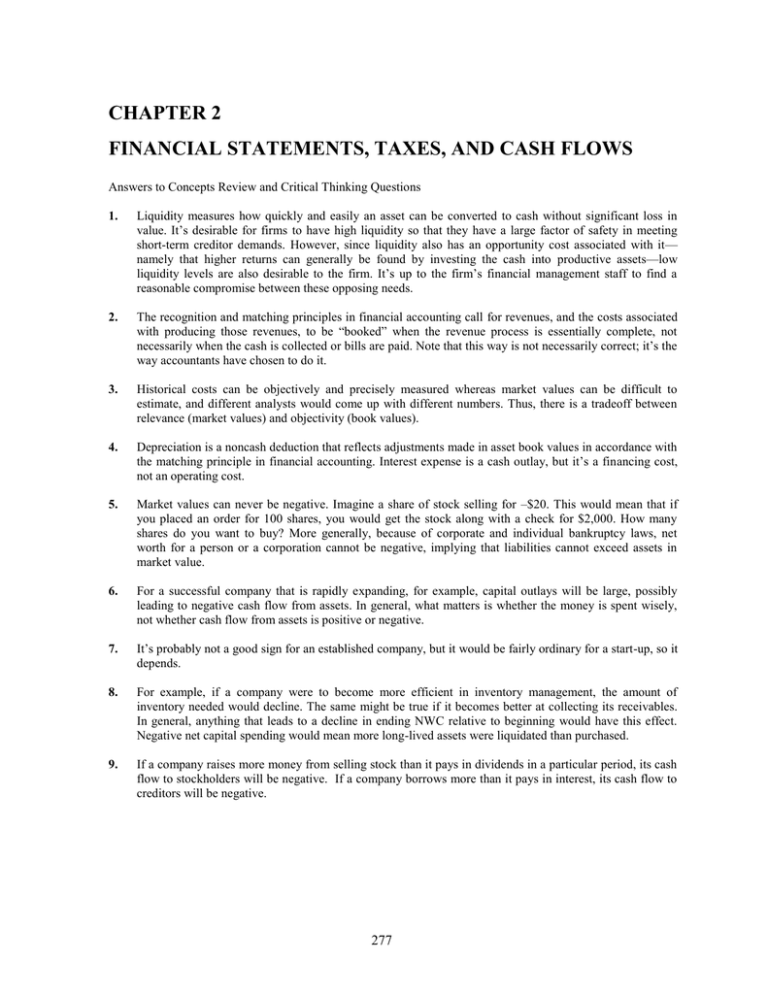

Answers To Chapter 2 Financial Statements Taxes And Cash Flows Pdf Net Income Equity Chapter 2 – financial statements, taxes, and cash flow fin 300 – fall 2021 course. This chapter is largely a review of key accounting concepts. balance sheet income statement taxes cash flow.

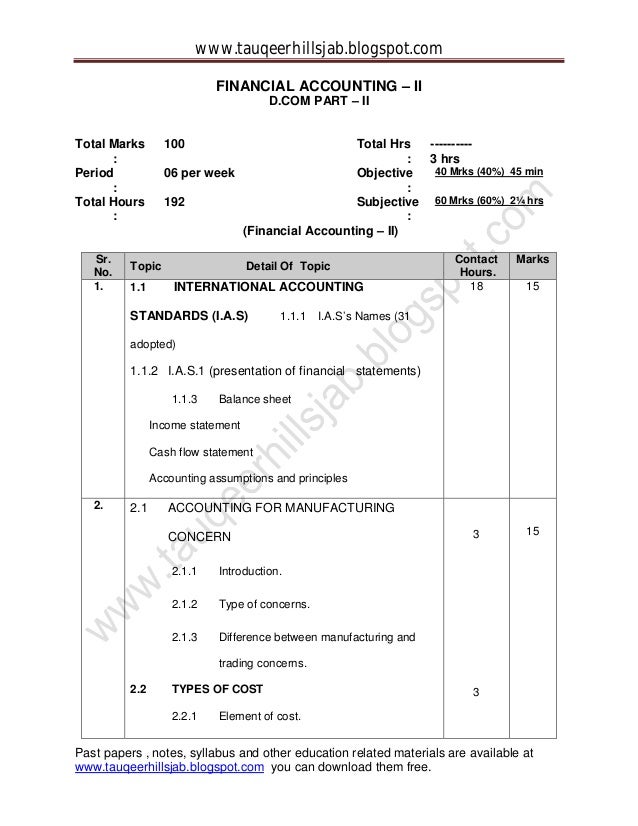

Financial Statements Taxes And Cash Flows Chapter 2 Solutions Handout fin300 chapter 2 2024 free download as pdf file (.pdf), text file (.txt) or view presentation slides online. To illustrate some important points about taxes for such entities, we take a look at personal tax rates in table 2.3. the percentage tax rates shown in table 2.3 are all marginal rates. It describes the income statement as showing revenues, expenses and profits over a period of time. the balance sheet provides a snapshot of assets, liabilities and shareholders' equity as of a point in time. the cash flow statement reports cash inflows and outflows during a period. Fin 300 lecture notes lecture 2: international financial reporting standards, operating cash flow, cash flow.

Financial Accounting 2 Lecture Notes Pdf Goodsitecoop It describes the income statement as showing revenues, expenses and profits over a period of time. the balance sheet provides a snapshot of assets, liabilities and shareholders' equity as of a point in time. the cash flow statement reports cash inflows and outflows during a period. Fin 300 lecture notes lecture 2: international financial reporting standards, operating cash flow, cash flow. On studocu you find all the lecture notes, summaries and study guides you need to pass your exams with better grades. C: statement of cash flows reports the impact of a firm's operating, investing, and financing activities on cash flows over an accounting period. may tell readers whether the firm generates the cash needed to grow, to pay debt, or to pay dividend, and whether external financing is required. Start studying fin 300 ch 2 financial statements, cash flow, and taxes. learn vocabulary, terms, and more with flashcards, games, and other study tools. It is important to point out that we are concerned with the taxes that we will pay if a decision is made. consequently, the marginal tax rate is what we should use in our analysis. point out that the tax rates discussed in the book are just federal taxes.

Comments are closed.