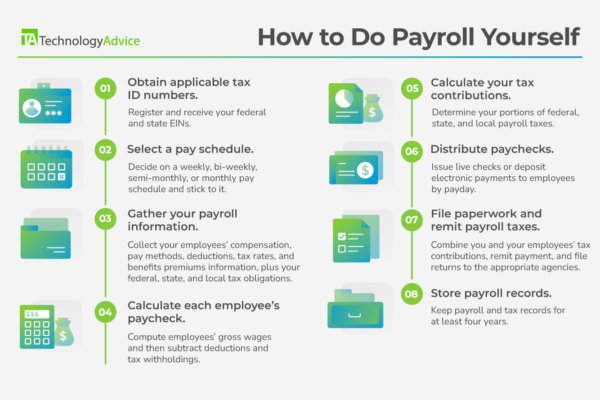

How To Do Payroll Yourself In 8 Steps

How To Do Payroll Yourself For Your Small Business In 2024 Here’s how to do payroll yourself in 8 easy steps. when people think about payroll, they automatically think of numbers. although mathematics is required, understanding the entire process is required to learn how to handle payroll. Learn how to do payroll yourself with this comprehensive guide for small business owners. find diy payroll steps, key terms, and tips to simplify payroll processing.

How To Do Payroll A Step By Step Guide In Six Easy Steps Geekbooks Learn for the full article step by step visit: fitsmallbusiness how to do payroll visit gusto for a free t. Using this payroll guide, we’ll walk you through the entire payroll process step by step. keep reading to learn about the different processing methods or jump right to the section that’s most relevant to you. Simply put, payroll is the complete process of calculating, distributing, and reporting employee wages. it encompasses various tasks such as tracking work hours, determining pay rates, and withholding the appropriate taxes. compliance with local, state, and federal regulations is crucial. “opting to do payroll yourself is an ambitious undertaking,” explains tom. “it can be done, but it entails a lot of work, especially for beginners. in my experience, here’s an overview of the various tasks and processes you want have top of mind.” establish a sensible framework.

Fillable Online How To Do Payroll Yourself In 8 Steps Free Checklist Fax Email Print Pdffiller Simply put, payroll is the complete process of calculating, distributing, and reporting employee wages. it encompasses various tasks such as tracking work hours, determining pay rates, and withholding the appropriate taxes. compliance with local, state, and federal regulations is crucial. “opting to do payroll yourself is an ambitious undertaking,” explains tom. “it can be done, but it entails a lot of work, especially for beginners. in my experience, here’s an overview of the various tasks and processes you want have top of mind.” establish a sensible framework. Once you have an ein, you can start programming your payroll software to pay employees on a regular basis. of course, to do so, you first need to decide how often you plan to pay employees. To complete payroll manually, start by gathering information about each employee’s pay, benefits, deductions, and tax withholding. tread carefully: in learning how to do payroll yourself, you’ll also need a thorough understanding of federal, state, and local labor laws and tax codes. In this guide, we’ll explain how to do payroll yourself, specifically for small businesses based in the united states, from choosing the right payroll software to calculating compensation and withholdings. Learning how to do payroll yourself might be a smart move, as it can save you money and give you better oversight of your company’s finances. however, payroll management can feel daunting without the right game plan and tools.

How To Do Payroll Yourself Archives Wiredgorilla Once you have an ein, you can start programming your payroll software to pay employees on a regular basis. of course, to do so, you first need to decide how often you plan to pay employees. To complete payroll manually, start by gathering information about each employee’s pay, benefits, deductions, and tax withholding. tread carefully: in learning how to do payroll yourself, you’ll also need a thorough understanding of federal, state, and local labor laws and tax codes. In this guide, we’ll explain how to do payroll yourself, specifically for small businesses based in the united states, from choosing the right payroll software to calculating compensation and withholdings. Learning how to do payroll yourself might be a smart move, as it can save you money and give you better oversight of your company’s finances. however, payroll management can feel daunting without the right game plan and tools.

How To Do Payroll Yourself Manual Calculations Or Software In this guide, we’ll explain how to do payroll yourself, specifically for small businesses based in the united states, from choosing the right payroll software to calculating compensation and withholdings. Learning how to do payroll yourself might be a smart move, as it can save you money and give you better oversight of your company’s finances. however, payroll management can feel daunting without the right game plan and tools.

How To Do Payroll Yourself For Small Business

Comments are closed.