How To Understand Your Cp114 Notice Math Error Resulting In Tax Refund On Your Form 720

Where S My Irs Refund Math Error Delays Still Processing If you agree with our changes, correct the copy of your excise tax return that you kept for your records. you should receive a refund of any overpayment shortly, if you haven’t already, and if you don't owe additional amounts we're required to collect. How to understand your cp114 notice (math error resulting in tax refund on your form 720) teach me! personal finance.

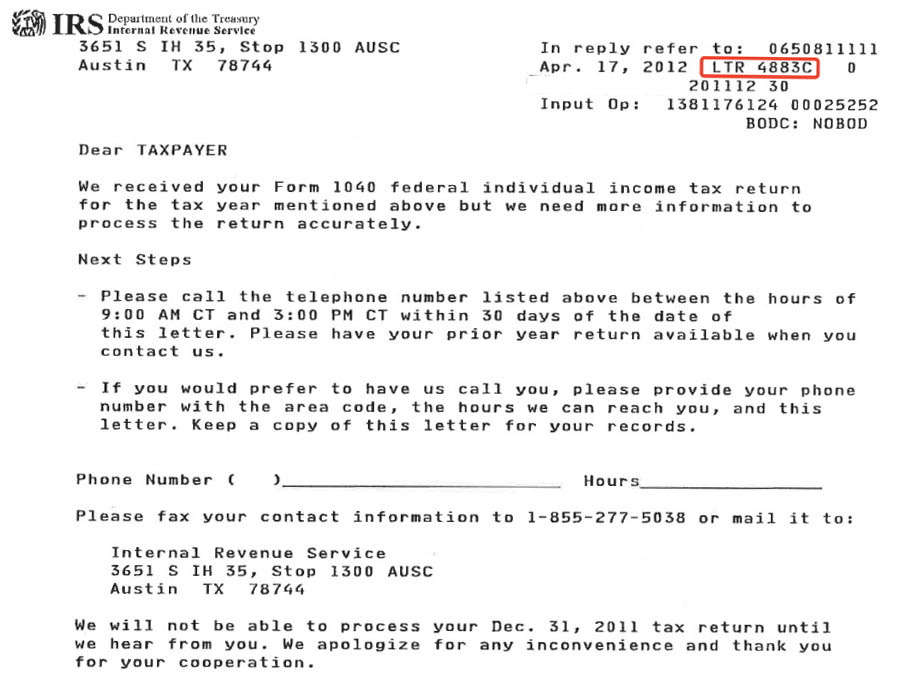

Deciphering The Cp 11a Notice Understanding Your Tax Return S Math Error These notices are mainly related to calculation errors found in your tax return that the irs was able to adjust. as a result, your refund amount may change or you may owe additional taxes. Make sure you read the entirety of your math error notice. the “header” in the top right hand corner will let you know what type of notice, your taxpayer identification number, and a phone number to contact the irs. Read your notice carefully to see what was changed on your return and how those changes affected the amount you owe. pay the amount owed by the date shown on your notice to avoid additional penalties and interest. make arrangements to pay over time if you can't pay the full amount right now. Did you receive an irs notice or letter? search for your notice or letter to learn what it means and what you should do.

Tax Refund Irs Tax Refund Error Read your notice carefully to see what was changed on your return and how those changes affected the amount you owe. pay the amount owed by the date shown on your notice to avoid additional penalties and interest. make arrangements to pay over time if you can't pay the full amount right now. Did you receive an irs notice or letter? search for your notice or letter to learn what it means and what you should do. Read your notice carefully to see what was changed on your return and how those changes affected your refund. if you agree with the changes we made, no response is required. Learn how to effectively address irs cp14 notices, understand their purpose, and explore your payment and dispute options. Understanding what each notice means and how to respond appropriately can help avoid unnecessary anxiety and resolve the matter quickly. we are going to break down the most common irs notices and what actions to take when one is received. The irs was able to correct computation errors in your tax return, which resulted in these letters. as a result, the quantity of your refund could fluctuate, or you could owe extra taxes.

Comments are closed.