How To Understand Your Cp116 Notice Math Error On Form 990 Pf 5227 5330 Or 4720 With Refund

Form 990 Pf For Private Foundations Pdf Charitable Organization Public Finance We believe you have miscalculations on your return. the changes we made resulted in a refund. compare the figures on your tax return with the figures on the notice. make the changes to your copy of your tax return for your records. pay the amount you owe by the date on the notice's payment coupon. How to understand your cp116 notice (math error on form 990 pf, 5227, 5330 or 4720 with refund) teach me! personal finance.

What Is Form 990 Pf Fill Online Printable Fillable Blank Millions of taxpayers have received math error notices adjusting their returns, including the amount of recovery rebate credit (rrc), child tax credit, or other items claimed on their return. Make sure you read the entirety of your math error notice. the “header” in the top right hand corner will let you know what type of notice, your taxpayer identification number, and a phone number to contact the irs. If you believe the error code was received mistakenly, you can contact the irs directly for help resolving the matter. the irs tax exempt hotline is 877 829 5500. To address a cp116 notice, you need to either pay the amount due or dispute the balance if there is an error. the first step is to carefully read the notice to understand the details of the outstanding balance and review your own tax records to verify its accuracy.

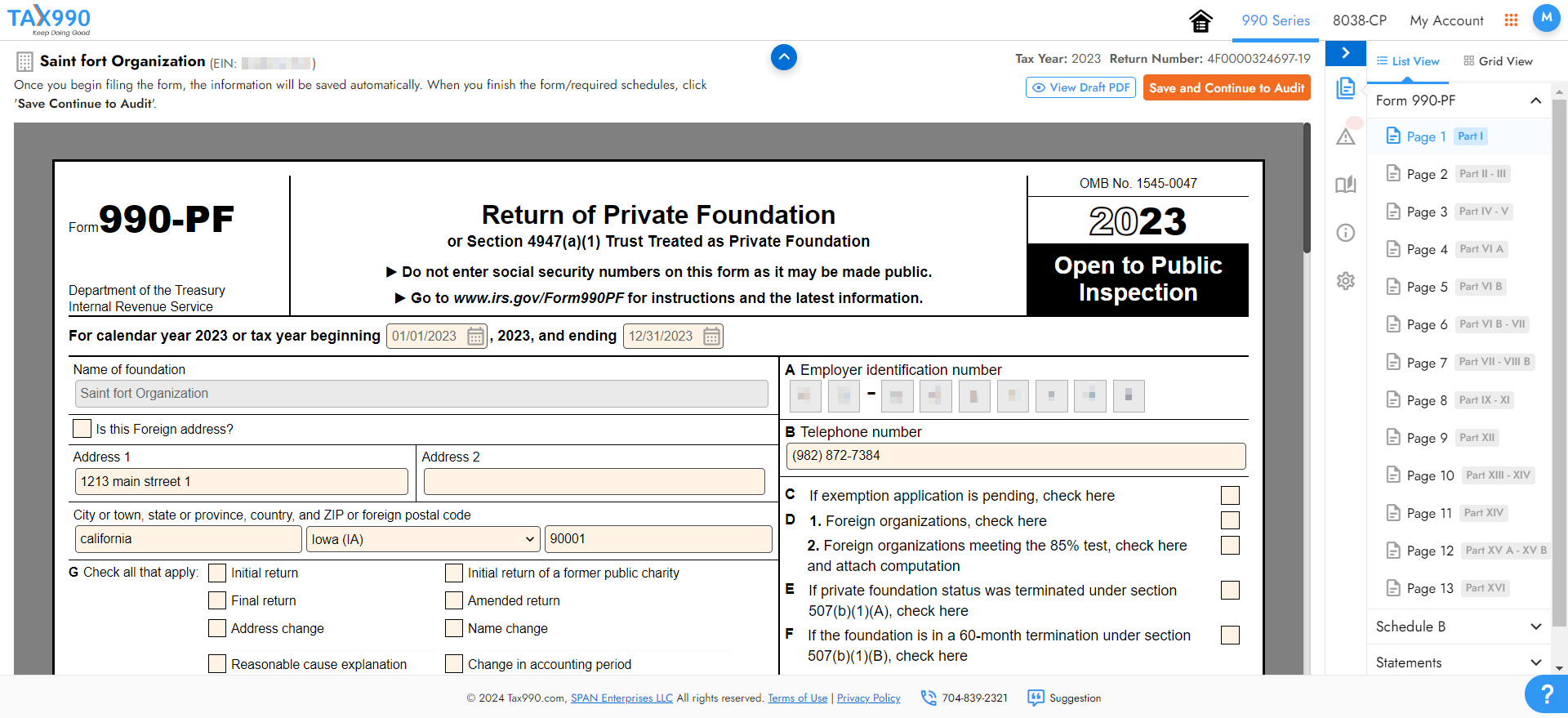

E File Form 990 Pf File Form 990 Pf Online If you believe the error code was received mistakenly, you can contact the irs directly for help resolving the matter. the irs tax exempt hotline is 877 829 5500. To address a cp116 notice, you need to either pay the amount due or dispute the balance if there is an error. the first step is to carefully read the notice to understand the details of the outstanding balance and review your own tax records to verify its accuracy. These 12 tips represent the most significant and most common errors made by preparers, however the tips list is not all inclusive, nor is it designed to be. be sure to read the irs instructions to form 990, form 990 ez, schedule a, and schedule b thoroughly. This article describes the most common errors made when preparing irs form 990 pf for private foundations. Incorrect compensation information: it’s important that your organization completes form 990 part vii, section a correctly. this section addresses compensation with respect to current and former officers, directors, trustees and key employees. If you are filing form 990 pf because you no longer meet a public support test under section 509 (a) (1) and you haven't previously filed form 990 pf, check initial return of a former public charity in item g of the heading section on page 1 of your return.

Fillable Online Form 990 990 Tax Forms Candid2020 Instructions For Form 990 Pf Irs Tax These 12 tips represent the most significant and most common errors made by preparers, however the tips list is not all inclusive, nor is it designed to be. be sure to read the irs instructions to form 990, form 990 ez, schedule a, and schedule b thoroughly. This article describes the most common errors made when preparing irs form 990 pf for private foundations. Incorrect compensation information: it’s important that your organization completes form 990 part vii, section a correctly. this section addresses compensation with respect to current and former officers, directors, trustees and key employees. If you are filing form 990 pf because you no longer meet a public support test under section 509 (a) (1) and you haven't previously filed form 990 pf, check initial return of a former public charity in item g of the heading section on page 1 of your return.

E File Form 990 Pf File Form 990 Pf Online Incorrect compensation information: it’s important that your organization completes form 990 part vii, section a correctly. this section addresses compensation with respect to current and former officers, directors, trustees and key employees. If you are filing form 990 pf because you no longer meet a public support test under section 509 (a) (1) and you haven't previously filed form 990 pf, check initial return of a former public charity in item g of the heading section on page 1 of your return.

Comments are closed.