Mutual Funds Vs Index Funds Vs Etfs Understanding The Differences

Mutual Funds Vs Index Funds Vs Etfs Understanding The Differences When determining the asset allocation for your portfolio, it helps to understand key differences between an etf vs. index fund vs. mutual fund to ensure you make the right investment decisions for your future. The choice between etfs and index mutual funds typically comes down to management fees, shareholder transaction costs, taxation, and other qualitative differences.

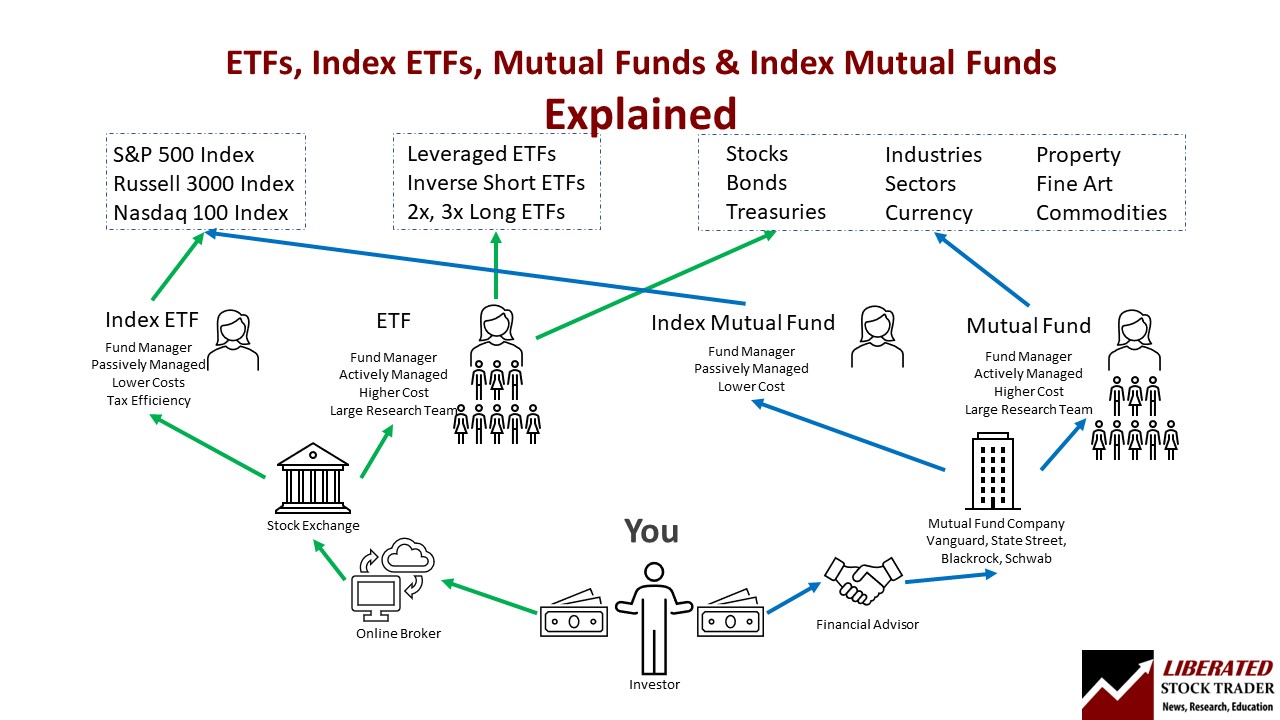

Etfs Vs Index Funds Vs Mutual Funds Cpf Capital Exchange traded funds (etfs), mutual funds and index funds are all common investment products. while all three of these investment funds have similarities, there are key differences. The difference between etfs, mutual funds, and index funds is that etfs trade like stocks on an exchange, and mutual funds are actively managed private investments. to complicate things an index fund can be either an etf or a mutual fund. the world of index funds, etfs, and mutual funds is surprisingly difficult to understand. Learn the difference between a mutual fund and etf by comparing etf vs. mutual fund minimums, pricing, risk, management, and costs to decide what's best for you. you may be surprised by how similar etfs (exchange traded funds) and mutual funds are. just a few key differences set them apart. Unlike other popular investments (like stocks and etfs), mutual funds are not traded on an exchange. instead, you buy shares directly through the mutual fund company (or a broker for the fund). shares are bought and sold once per day when the market closes.

Etfs Vs Mutual Funds Vs Index Funds Simply Explained 2023 Learn the difference between a mutual fund and etf by comparing etf vs. mutual fund minimums, pricing, risk, management, and costs to decide what's best for you. you may be surprised by how similar etfs (exchange traded funds) and mutual funds are. just a few key differences set them apart. Unlike other popular investments (like stocks and etfs), mutual funds are not traded on an exchange. instead, you buy shares directly through the mutual fund company (or a broker for the fund). shares are bought and sold once per day when the market closes. If you're ready to get started buying stocks (or just curious) here are the similarities and differences of the three most basic options: a mutual fund, index fund and etf. what is an active mutual fund? a mutual fund is a basket of stocks, bonds, or other types of assets. Investing in the financial markets can be done through various ways like – etf, mutual funds, and index funds. consider these as different investment packages, where each one takes money from many investors and spreads it across different investments, like stocks and bonds. In this article, we’ll break down the differences between etfs, index funds, and mutual funds, help you understand their advantages and disadvantages, and guide you on how to choose the right one for your investment goals. what is an etf?. Etfs and index funds: lower costs, passive management and predictable returns make them ideal for cost conscious, long term investors. mutual funds: professional management offers.

Comments are closed.