Payment In Commutation Of Pension Received By The Employees Section 1010a Direct And

Pension Commutation | PDF

Pension Commutation | PDF Payment in commutation of pension received by the employees is exempt from income tax up to a certain limit under section 10 (10a) of the income tax act, 1961. the exemption limit is as follows: central government employees: entire amount of the commuted pension is exempt. state government employees: entire amount of the commuted pension is exempt. Provisions of section 10 (10a) provide exemption towards the commuted value of a pension. under the present article, we would understand the exemption available under section 10 (10a) of the income tax act.

EPF Pension Commutation Rules & Latest Updates

EPF Pension Commutation Rules & Latest Updates Commutation of pension refers to receiving a portion of a pension as a lump sum amount. it is generally available to government employees, defence personnel, and employees of public sector undertakings (psus) in india. Commuted value of pension = pension received / % of pension commuted. commuted pension received from pension fund established by lic or any other approved insurer under section 10 (23aab ) is exempt from tax for all employees. pension is taxable under the head income from salary. Summarising, commuted pension received by employees of central and state governments, local authority and statutory corporation is fully exempt from income tax. also commuted pension received from pension fund set up by lic or other insurer approved by irda is also fully exempt. Any payment received by an employee of the central government or a state government, as cash equivalent of the leave salary in respect of the period of earned leave at his credit at the time of his retirement, whether on superannuation or otherwise, is exempt under section 10 (10aa) (i).

Commutation Pension | PDF | Pension | Government

Commutation Pension | PDF | Pension | Government Summarising, commuted pension received by employees of central and state governments, local authority and statutory corporation is fully exempt from income tax. also commuted pension received from pension fund set up by lic or other insurer approved by irda is also fully exempt. Any payment received by an employee of the central government or a state government, as cash equivalent of the leave salary in respect of the period of earned leave at his credit at the time of his retirement, whether on superannuation or otherwise, is exempt under section 10 (10aa) (i). (ii) any payment in commutation of pension received under any scheme of any other employer, to the extent it does not exceed—. Payment in commutation of pension received by the employees is exempt from income tax up to a certain limit under section 10 (10a) of the income tax act, 1961. central government employees: entire amount of the commuted pension is exempt. state government employees: entire amount of the commuted pension is exempt. (a) employees of the central government/ local authorities/ statutory corporation/ members of the defence services: any commuted pension received is fully exempt from tax. (b) non government employee: any commuted pension received is exempt from tax in the following manner: i hope i did explain it in a easy way. upgrade to caclubindia pro. Commutation of pension refers to the process by which a pensioner converts a portion of their pension into a lump sum amount. under section 10 (10a) of the income tax act, 1961, specific provisions outline the tax treatment of such commutations.

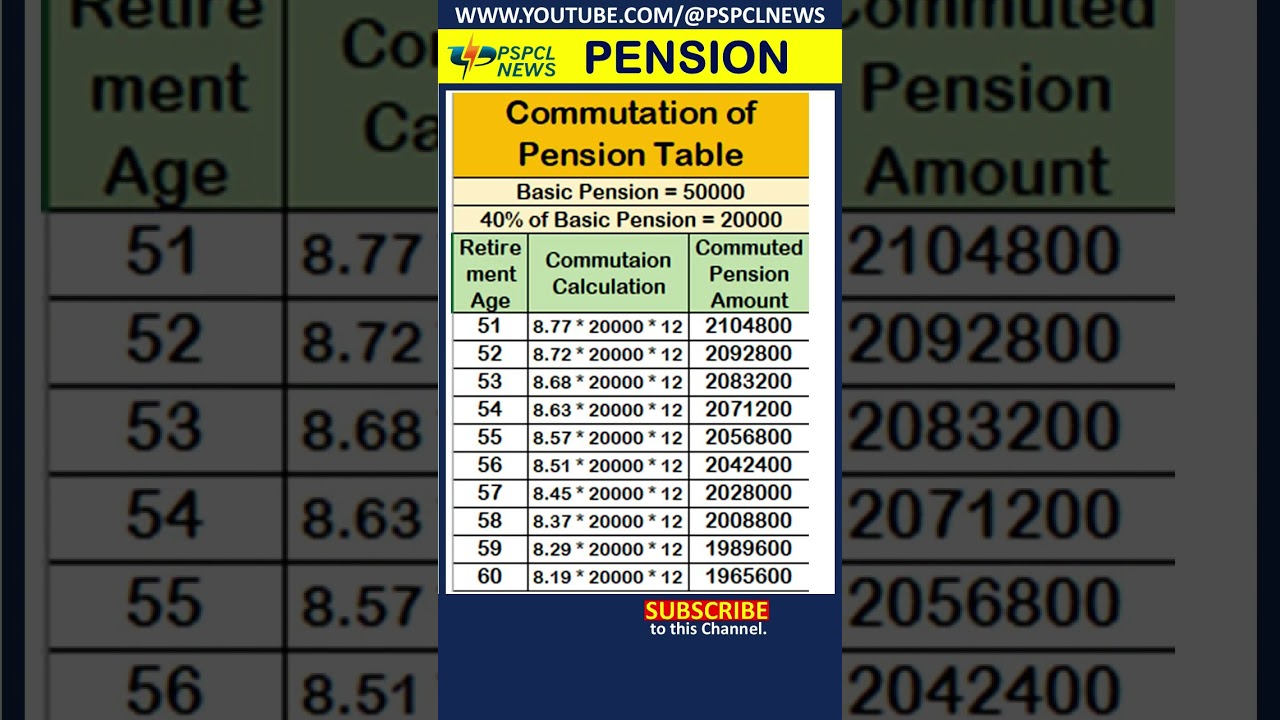

Commutation of Pension Table #commutation #pension #shorts #pspcl #news

Commutation of Pension Table #commutation #pension #shorts #pspcl #news

Related image with payment in commutation of pension received by the employees section 1010a direct and

Related image with payment in commutation of pension received by the employees section 1010a direct and

About "Payment In Commutation Of Pension Received By The Employees Section 1010a Direct And"

Comments are closed.