Present Value

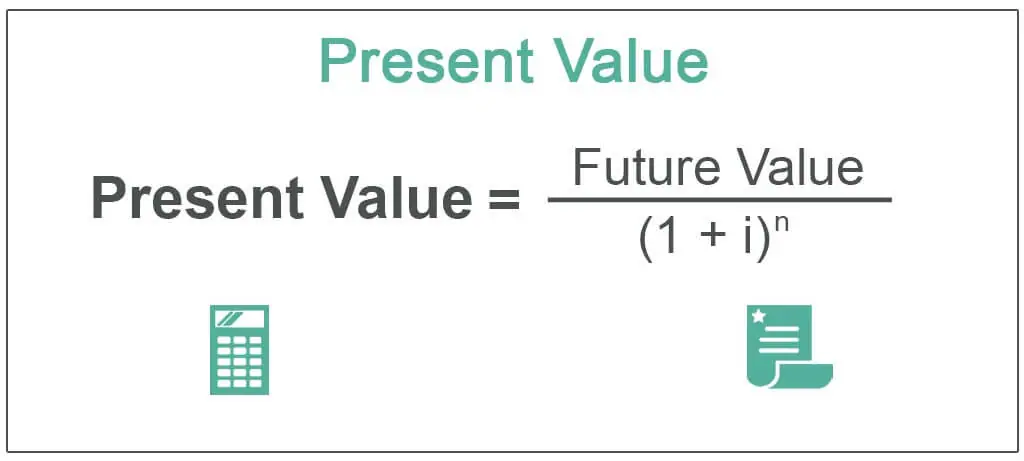

Present Value Formulas Examples How To Calculate Penpoin Present value (pv) is calculated by discounting the future value by the estimated rate of return that the money could earn if invested. Calculate the present value of a future amount or a stream of annuity payments using this free online tool. learn the definition, formula, and examples of present value and net present value in finance.

:max_bytes(150000):strip_icc()/presentvalue_final-c101ebc8f0704d31a67aabd808d8349f.jpg)

Present Value Of An Annuity Meaning Formula And Example 51 Off What is present value (pv)? present value is a financial concept that represents the current worth of a sum of money or a series of cash flows expected to be received in the future. Learn what present value (pv) is in economics and finance, how it relates to time value of money and interest rates, and how to calculate it for different cash flows and scenarios. find examples, formulas, and references for pv concepts and applications. Learn how to calculate the present value (pv) of a future sum of money using a discount rate and a formula. pv helps investors compare the value of different investments over time and assess their potential returns. Learn how to calculate present value (pv) of future cash flows using a simple formula and an excel template. pv is the current value of money you expect from future income, discounted at a specified rate of return.

Easy To Use Present Value Calculator For Instant Results Learn how to calculate the present value (pv) of a future sum of money using a discount rate and a formula. pv helps investors compare the value of different investments over time and assess their potential returns. Learn how to calculate present value (pv) of future cash flows using a simple formula and an excel template. pv is the current value of money you expect from future income, discounted at a specified rate of return. Present value (pv) is a measure of how much a future cash flow, or stream of cash flows, is worth as of the current date. Present value is a way of measuring the current value of future cash flows. it’s a financial concept that has a broad range of applications, including real estate, investing, or business. Present value (pv): definition, example calculations, and interpretation of this metric in valuation and deals. Present value (pv) is the value of an expected sum of money discounted by compounding interest rates to the present day.

Present Value Present Value Annuity Excel Investment Present value (pv) is a measure of how much a future cash flow, or stream of cash flows, is worth as of the current date. Present value is a way of measuring the current value of future cash flows. it’s a financial concept that has a broad range of applications, including real estate, investing, or business. Present value (pv): definition, example calculations, and interpretation of this metric in valuation and deals. Present value (pv) is the value of an expected sum of money discounted by compounding interest rates to the present day.

Present Value Definition Example Step By Step Guide Present value (pv): definition, example calculations, and interpretation of this metric in valuation and deals. Present value (pv) is the value of an expected sum of money discounted by compounding interest rates to the present day.

Present Value Numeritas

Comments are closed.