Revolutionize Your Banking Finance With Fintech Solutions Cis Solutions Takes The Lead

How Fintech Solutions Are Reshaping The Future Of Banking Finance Financial institutions are rethinking about their delayed traditional methods and slowly adopting to the fintech solutions that defines how they are providin. Find high end technology and finance management software that allows you to efficiently manage your business anytime and anywhere. with elevated customer experience and quicker solutions, our finance industry solutions can help you generate a wider revenue stream without compromising on interactivity with your customers.

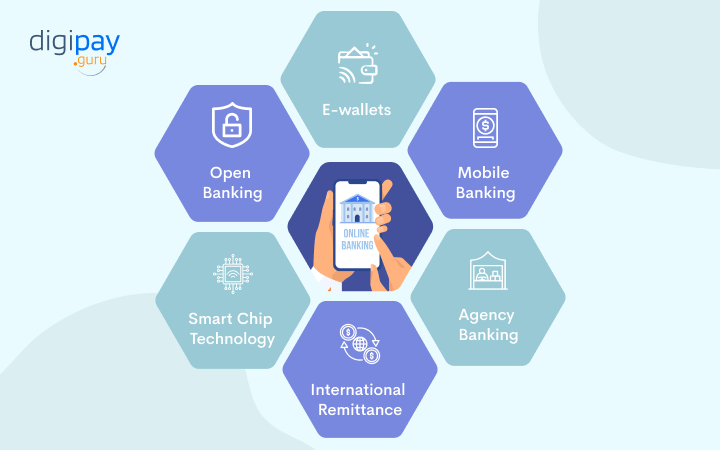

Unveiling Fintech Revolutionizing The Future Of Banking With a focus on security, efficiency and transparency in investment dealings, verivend is leading the way in fintech solutions designed for the expansive private capital industry. The review underscores that fintech innovations have the potential to revolutionize the financial services industry, paving the way for a more inclusive, efficient, and customer centric. From mobile banking to e wallets, fintech makes banking more efficient, accessible, and user friendly. fintech solutions are changing the way banks like you operate and how your customers interact with them. the ultimate goal of this is to provide faster, cheaper, and more secure banking services. Revolut is revolutionizing international banking by removing geographical barriers and enabling seamless global financial transactions. through its innovative fintech platform, users can hold multiple currencies, make cross border payments at low fees, and exchange money at interbank rates.

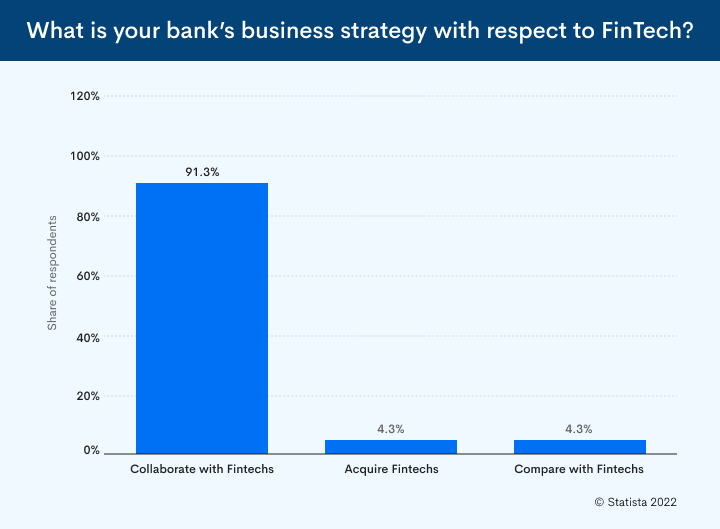

The Revolutionary Impact Of Fintech Solutions Swissmoney From mobile banking to e wallets, fintech makes banking more efficient, accessible, and user friendly. fintech solutions are changing the way banks like you operate and how your customers interact with them. the ultimate goal of this is to provide faster, cheaper, and more secure banking services. Revolut is revolutionizing international banking by removing geographical barriers and enabling seamless global financial transactions. through its innovative fintech platform, users can hold multiple currencies, make cross border payments at low fees, and exchange money at interbank rates. In the united states, the fintech revolution is reshaping the banking landscape, as illustrated through various statistics and trends. by examining multi currency accounts, embedded insurance, ai driven wealth management, and other innovations, we can appreciate how fintech is not merely an industry sidekick but a key architect of financial. The americas attracted more than half of the fintech investment seen globally during h1’25 ($26.7 billion), led by the $2.6 billion acquisition of us based next insurance. the emea region came a distant second, attracting $13.7 billion in in fintech investment, led by the $3.2 billion buyout of uk based preqin, while the aspac region saw just $4.3 billion in investment, led by the. In this comprehensive guide, we will delve into the transformative impact of fintech on banking and investment practices, explore key innovations driving this revolution, and provide practical insights to help you navigate the changing financial landscape. Banks are able to improve efficiency and deliver more tailored services to clients by using fintech solutions to help optimize their processes and cut expenses.

Top Fintech Solutions Changing The Banking Industry In the united states, the fintech revolution is reshaping the banking landscape, as illustrated through various statistics and trends. by examining multi currency accounts, embedded insurance, ai driven wealth management, and other innovations, we can appreciate how fintech is not merely an industry sidekick but a key architect of financial. The americas attracted more than half of the fintech investment seen globally during h1’25 ($26.7 billion), led by the $2.6 billion acquisition of us based next insurance. the emea region came a distant second, attracting $13.7 billion in in fintech investment, led by the $3.2 billion buyout of uk based preqin, while the aspac region saw just $4.3 billion in investment, led by the. In this comprehensive guide, we will delve into the transformative impact of fintech on banking and investment practices, explore key innovations driving this revolution, and provide practical insights to help you navigate the changing financial landscape. Banks are able to improve efficiency and deliver more tailored services to clients by using fintech solutions to help optimize their processes and cut expenses.

Top Fintech Solutions Changing The Banking Industry In this comprehensive guide, we will delve into the transformative impact of fintech on banking and investment practices, explore key innovations driving this revolution, and provide practical insights to help you navigate the changing financial landscape. Banks are able to improve efficiency and deliver more tailored services to clients by using fintech solutions to help optimize their processes and cut expenses.

Fintech Solutions For Digital Transformation In The Finance Industry

Comments are closed.