Risk Adjusted Returns Using Ai Exclusive Lesson

Ai And Machine Learning For Risk Management Pdf Machine Learning Intelligence Ai Semantics Exclusive lesson: risk adjusted returns using ai enroll in this course: full course title: financial modeling with generative ai certification course l. Explore an in depth lesson from the premium course: financial modeling with generative ai. gain valuable skills and insights in risk adjusted returns using ai.

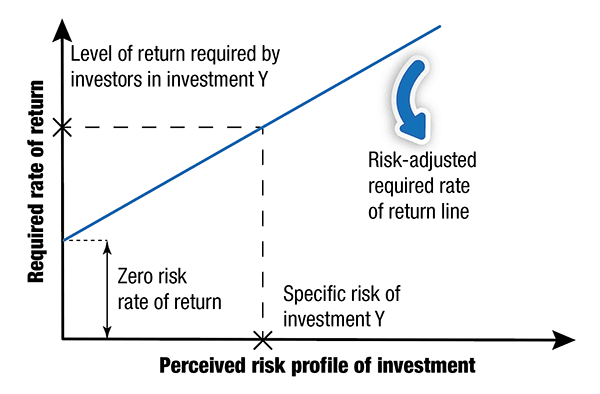

Risk Adjusted Returns In this white paper, we’ll explore the challenges of traditional risk adjustment approaches, benefits of ai powered ra, and real world results of coding with an ai powered solution. Because there are different ways to measure risk, there isn't a single, perfect way to calculate risk adjusted return 📚 but there are several popular ways people estimate it, and next, we'll introduce you to 3 of them!. To put ai risk adjusted return into practice, i created a trading bot using a popular machine learning framework. i trained the model on a dataset of historical market data, and then deployed it to a live trading environment. In this article, we will explore the essential relationship between risk and return, how ai integrates with traditional financial forecasting methods, the new opportunities and challenges it presents, and some significant case studies showcasing its practical applications.

Understanding Risk Adjusted Returns Avalon To put ai risk adjusted return into practice, i created a trading bot using a popular machine learning framework. i trained the model on a dataset of historical market data, and then deployed it to a live trading environment. In this article, we will explore the essential relationship between risk and return, how ai integrates with traditional financial forecasting methods, the new opportunities and challenges it presents, and some significant case studies showcasing its practical applications. Explore how smart beta strategies optimize risk adjusted returns, offering insights into performance drivers, challenges, and future trends in modern investing. By leveraging ai for corrective and adaptive purposes, asset managers can achieve better performance, manage risks more effectively, and gain a competitive edge in the ever evolving financial landscape. This intelligent system combines financial modeling with machine learning to construct, optimize, and rebalance portfolios based on clients' investment mandates, market signals, and risk preferences. Exclusive lesson: risk adjusted return on capital raroc enroll in this course: full course title: associate professional risk manager aprm certification.

Understanding Risk Adjusted Returns Avalon Explore how smart beta strategies optimize risk adjusted returns, offering insights into performance drivers, challenges, and future trends in modern investing. By leveraging ai for corrective and adaptive purposes, asset managers can achieve better performance, manage risks more effectively, and gain a competitive edge in the ever evolving financial landscape. This intelligent system combines financial modeling with machine learning to construct, optimize, and rebalance portfolios based on clients' investment mandates, market signals, and risk preferences. Exclusive lesson: risk adjusted return on capital raroc enroll in this course: full course title: associate professional risk manager aprm certification.

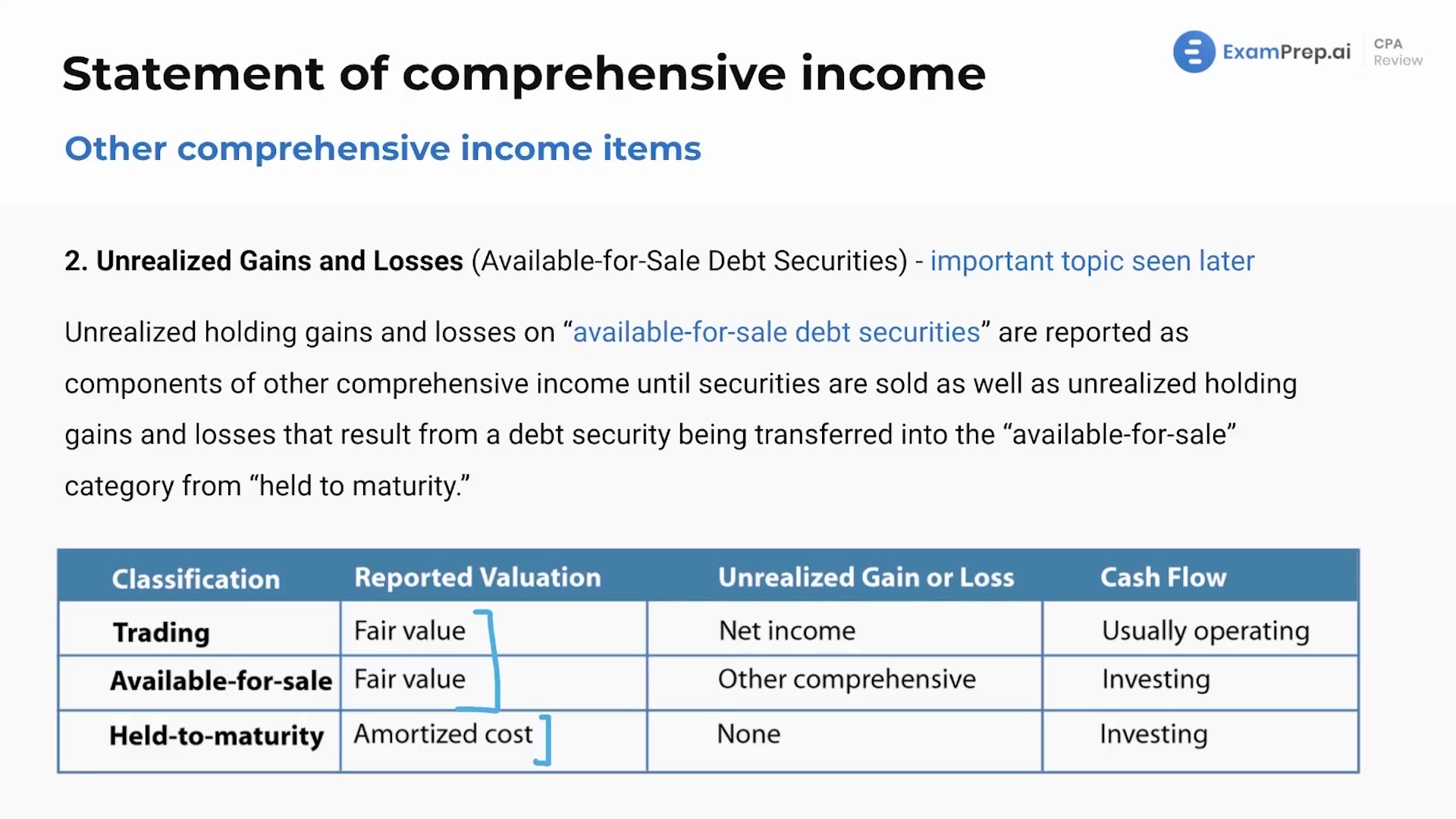

Instrument Specific Credit Risk This intelligent system combines financial modeling with machine learning to construct, optimize, and rebalance portfolios based on clients' investment mandates, market signals, and risk preferences. Exclusive lesson: risk adjusted return on capital raroc enroll in this course: full course title: associate professional risk manager aprm certification.

Risk Adjusted Returns The Investor S Gate

Comments are closed.