Solved The Difference Between An Ipo And A Secondary Chegg

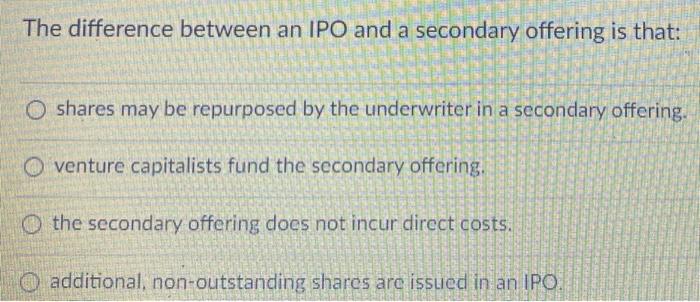

Difference Between Ipo And Secondary Offering Pdf Initial Public Offering Public Company The difference between an ipo and a secondary offering is that: a. the secondary offering does not incur direct costs. b. venture capitalists fund the secondary offering. c. additional, non outstanding shares are sold to new investors from the early investors. d. shares may be repurposed by the underwriter in a secondary offering. What is the difference between an ipo (initial public offering) and an seo (seasoned. equity offering)? 1. an ipo is the first time a formerly privately owned company sells stock to the general public. a seasoned issue is the issuance of stock by a company that has already undergone an ipo. 1.

Solved The Difference Between An Ipo And A Secondary Chegg Two frequently mentioned methods are initial public offerings (ipos) and secondary offerings. an ipo marks a company’s debut in the public market, whereas a secondary offering entails either the sale of existing shares or the issuance of new shares by a company that is already listed. One of the key differences between an ipo and a secondary offering is the purpose of the issuance. while an ipo is aimed at raising capital for the company, a secondary offering allows existing shareholders to sell their shares and realize profits. What is the difference between the secondary market and an ipo? the secondary market is where previous issued securities are bought and sold by investors. an ipo is the first sale of stock by a private company to the public. investors, including individuals and institutions, trade securities among themselves. What is the difference between an ipo and a secondary issue? an ipo is the first time issue of a company's securities, whereas a secondary offering is a new issue of a security that is already offered. what is the difference between a private placement and a public offering? a public offering represents the sale of a security to the public at.

What Is The Difference Between Ipo And Secondary Offering Similar Different What is the difference between the secondary market and an ipo? the secondary market is where previous issued securities are bought and sold by investors. an ipo is the first sale of stock by a private company to the public. investors, including individuals and institutions, trade securities among themselves. What is the difference between an ipo and a secondary issue? an ipo is the first time issue of a company's securities, whereas a secondary offering is a new issue of a security that is already offered. what is the difference between a private placement and a public offering? a public offering represents the sale of a security to the public at. Initial public offerings (ipos) occur when a private company sells shares of its stock on a public stock exchange for the first time. this allows the company to raise capital and become publicly traded. secondary offerings occur when major existing shareholders sell their shares on the public market. Question: 1) the difference between an ipo and a secondary offering is that: a. the secondary offering does not incur direct costs.u2028 b. venture capitalists fund the secondary offering.u2028 c. additional, non outstanding shares are sold to new investors from the early investors. The difference between an ipo and a secondary offering is that: a. the secondary offering does not incur direct costs b. venture capitalists fund the secondary offering c. additional, non outstanding shares are issued in an ipo d. shares may be repurposed by the underwriter in a secondary offering. What is the difference between an ipo (initial public offering) and an seo (seasoned equity offering)? an ipo is the first time a formerly privately owned company sells stock to the general public. a seasoned equity offering (or seasoned issuance) is the issuance of stock by a company that has already undergone an ipo.

Solved 6 Secondary Markets Once A Company Completes Its Chegg Initial public offerings (ipos) occur when a private company sells shares of its stock on a public stock exchange for the first time. this allows the company to raise capital and become publicly traded. secondary offerings occur when major existing shareholders sell their shares on the public market. Question: 1) the difference between an ipo and a secondary offering is that: a. the secondary offering does not incur direct costs.u2028 b. venture capitalists fund the secondary offering.u2028 c. additional, non outstanding shares are sold to new investors from the early investors. The difference between an ipo and a secondary offering is that: a. the secondary offering does not incur direct costs b. venture capitalists fund the secondary offering c. additional, non outstanding shares are issued in an ipo d. shares may be repurposed by the underwriter in a secondary offering. What is the difference between an ipo (initial public offering) and an seo (seasoned equity offering)? an ipo is the first time a formerly privately owned company sells stock to the general public. a seasoned equity offering (or seasoned issuance) is the issuance of stock by a company that has already undergone an ipo.

Comments are closed.