Stoploss Definition How It Works Types Example Mistakes To Avoid

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit Learn how stop loss orders limit losses and protect profits by automatically selling or buying securities when a specific price point is reached. Regardless of which type of stop loss you choose, you will have to choose between two different stop loss orders. both have their advantages and disadvantages, and depending on what you want to accomplish, one might be better than the other.

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit A stop loss is a type of order that investors or traders use to limit their potential losses in the stock market. here’s what it means and how to use it. A stop loss order sells the security at the next available market price once the stop trigger is reached. this guarantees execution but not a specific price, which poses risks in fast moving markets. A stop loss order is placed with a broker to buy or sell a security when it reaches a certain price. A stop loss order is one of the main order types you can use easily to avoid huge losses. learn how you can calculate it and use it at major online brokerages.

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit

Best 12 Stoploss: Definition, How It Works, Types, Example, Mistakes To Avoid – Artofit A stop loss order is placed with a broker to buy or sell a security when it reaches a certain price. A stop loss order is one of the main order types you can use easily to avoid huge losses. learn how you can calculate it and use it at major online brokerages. A stop loss order is a risk management strategy that traders and investors use to reduce possible investment losses by automatically executing a sell order if the asset's price hits a certain level. stop loss orders are generally set for long trades below the current market price and short positions above the price.

Stoploss Methods | PDF | Order (Exchange) | Day Trading

Stoploss Methods | PDF | Order (Exchange) | Day Trading A stop loss order is a risk management strategy that traders and investors use to reduce possible investment losses by automatically executing a sell order if the asset's price hits a certain level. stop loss orders are generally set for long trades below the current market price and short positions above the price.

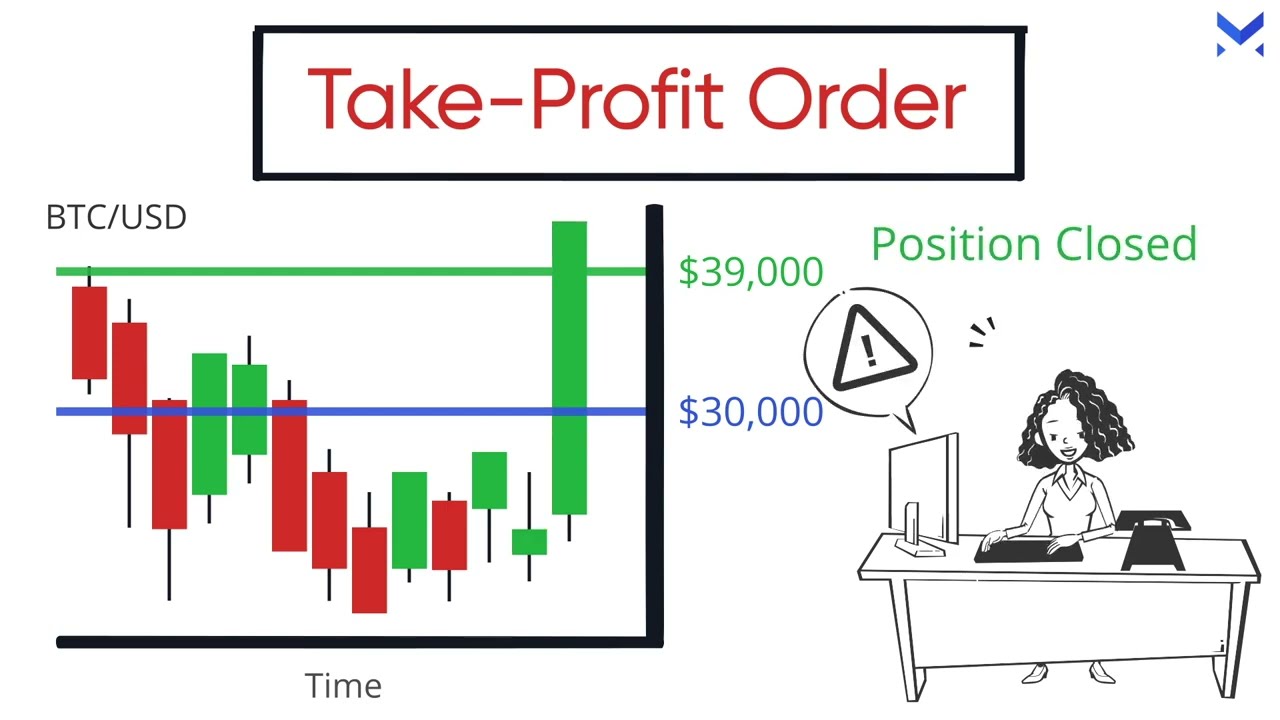

What are stop loss and take profit orders and how to use them effectively when trading?

What are stop loss and take profit orders and how to use them effectively when trading?

Related image with stoploss definition how it works types example mistakes to avoid

Related image with stoploss definition how it works types example mistakes to avoid

About "Stoploss Definition How It Works Types Example Mistakes To Avoid"

Comments are closed.