Tally Prime Invoice

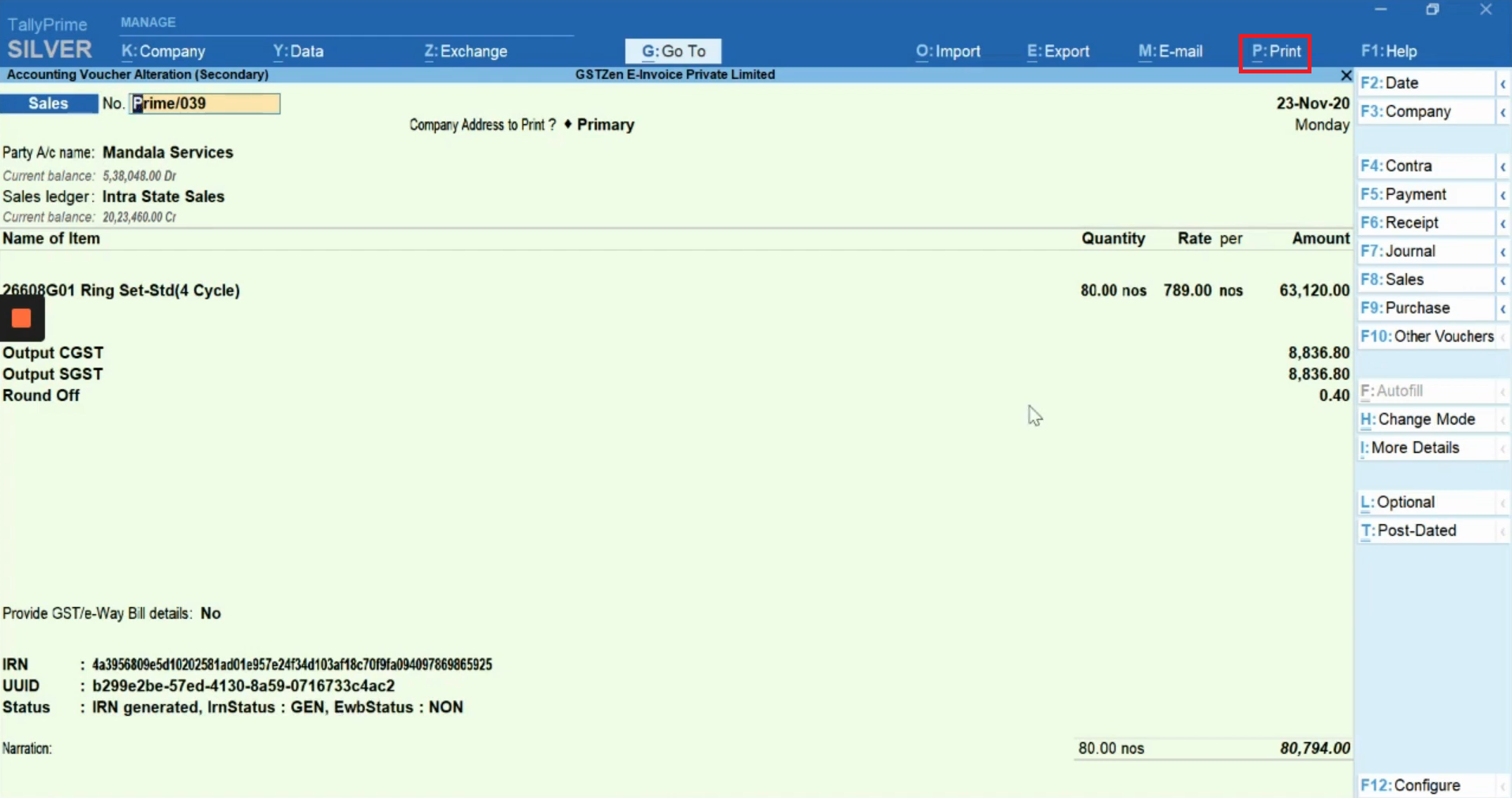

Tally Prime Invoice E invoicing is a system that allows the invoice registration portal (irp) to electronically verify b2b invoices. accordingly, e invoicing in tallyprime provides you with a smooth experience to configure and generate e invoices for your business. once your e invoice is generated successfully, the details of the e invoice will reflect in gstr 1. Learn how tallyprime's invoicing and accounting features streamline billing, compliance, and financial management for your small business. explore now!.

Tally Prime Invoice There are multiple configurations with additional details you can do before printing your invoice which has been described in details with examples here … (1) change of invoice title. (2) print sales invoice with company logo. (3) printing bank details in sales invoice. (4) change declaration terms & conditions in sales invoices. In this guide, we will explore the world of e invoice in tally prime, covering its benefits, features, and steps to get started. if you are looking for a way to simplify your invoicing process, improve accuracy, and ensure compliance, then e invoice in tally prime is a great option. how to activate the e invoice in tally prime?. Learn how to create professional business invoices in tallyprime with this easy step by step guide for efficient billing and accounting. Add to favourites pdfgenerate e invoice on irp using tallyprime e invoicing allows the invoice registration portal (irp) to electronically verify b2b invoices. accordingly, e invoicing in tallyprime provides you with a smooth experience to configure and generate e invoices for your business. once your e invoice is generated successfully, the details of the e invoice will reflect in gstr 1.

Tally Prime Export Invoice Learn how to create professional business invoices in tallyprime with this easy step by step guide for efficient billing and accounting. Add to favourites pdfgenerate e invoice on irp using tallyprime e invoicing allows the invoice registration portal (irp) to electronically verify b2b invoices. accordingly, e invoicing in tallyprime provides you with a smooth experience to configure and generate e invoices for your business. once your e invoice is generated successfully, the details of the e invoice will reflect in gstr 1. In the evolving landscape of digital taxation in india, e invoicing has become a pivotal component for businesses to ensure gst compliance. tally prime, a widely used accounting software, offers integrated features to facilitate e invoicing seamlessly. Tallyprime provides you with an online e invoicing solution that fits right into your regular invoicing process. e invoicing in tallyprime is not restricted to only a particular voucher type. apart from regular sales invoice, tallyprime supports e invoicing for pos, debit notes, and credit notes. With tallyprime’s fully connected e invoicing solution, you can generate e invoices instantly, with zero manual processes. just record the invoice and print, tallyprime will automatically add irn and qr code. you can either generate an e invoice in the flow of recording invoice or do this in bulk for multiple invoices together. With tallyprime’s fully integrated einvoice software solution, generate e invoices instantly without altering your existing invoicing process. automatically generate e invoices and print irn & qr code on the invoices seamlessly, eliminating the need for manual intervention.

Comments are closed.