The Great Moderation Is Over Here Is What Comes Next Practical Lessons From Liz Ann Sonders

Liz Ann Sonders Backdrop Books In this episode, we break down key lessons from our conversation with liz ann sonders, chief investment strategist at charles schwab, exploring timeless investment principles and market dynamics that remain relevant regardless of current market conditions. In this episode, we break down key lessons from our conversation with liz ann sonders, chief investment strategist at charles schwab, exploring timeless investment principles and market.

Great Moderation Wikiwand New episode: matt zeigler and i play the highlights and cover the biggest lessons from our interview with liz ann sonders why the great moderation is over why valuation isn't. The “great moderation” is over: why the low inflation, low volatility environment of the past few decades probably isn’t coming back (from liz ann sonders and kevin gordon at charles schwab on september 18)…. With all that in mind, i found the following excerpts from a recent podcast featuring liz ann sonders, chief investment strategist at charles schwab, to be of particular interest (link to full episode of this excess returns podcast at bottom of article). In this episode of excess returns, we sit down with liz ann sonders, chief investment strategist at charles schwab, for a wide ranging discussion about markets, the economy, and investing.

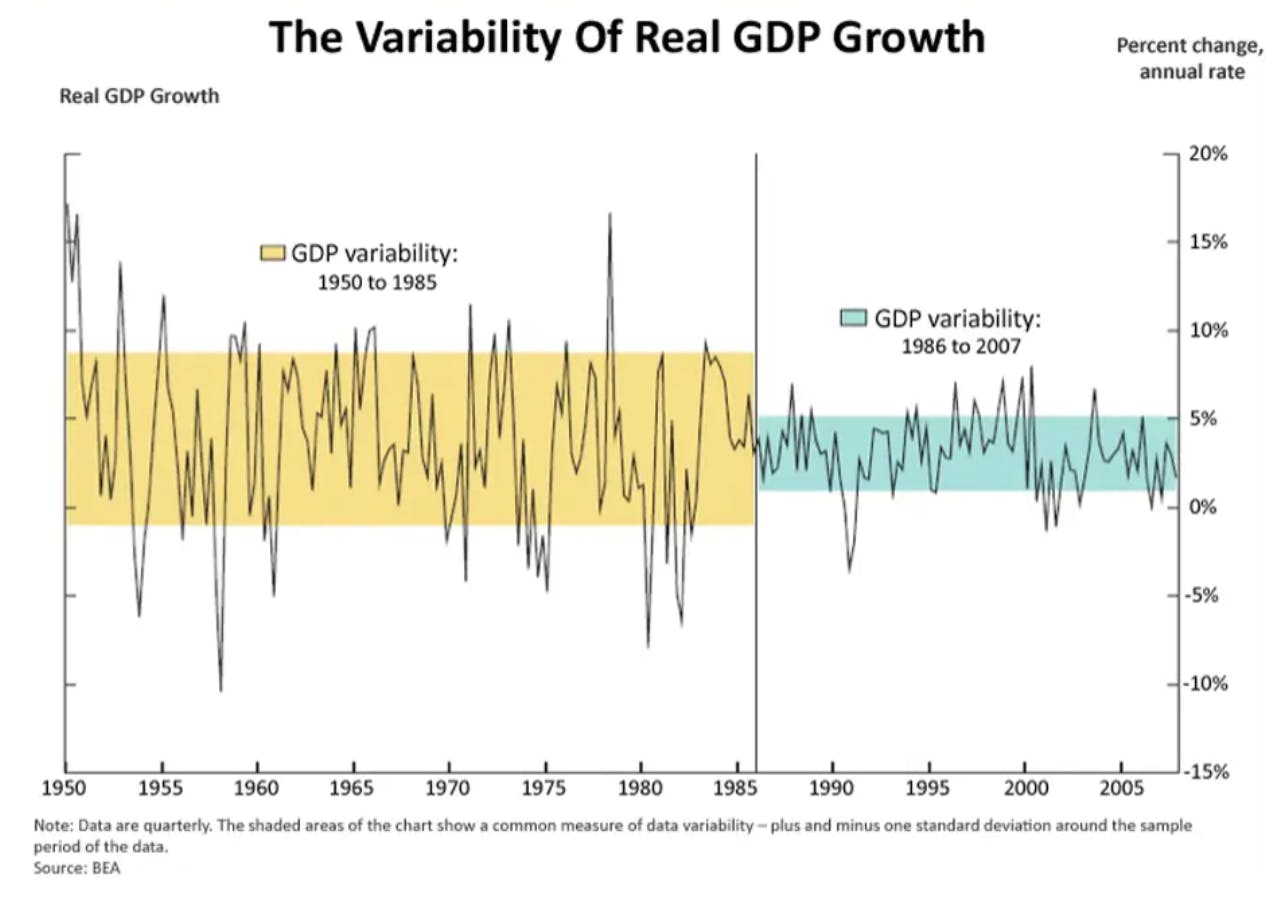

The Great Moderation With all that in mind, i found the following excerpts from a recent podcast featuring liz ann sonders, chief investment strategist at charles schwab, to be of particular interest (link to full episode of this excess returns podcast at bottom of article). In this episode of excess returns, we sit down with liz ann sonders, chief investment strategist at charles schwab, for a wide ranging discussion about markets, the economy, and investing. Investors may not know what to think, but sonders expects the current fog to lift a bit when we get the next batch of quarterly reports in april. but it might not be a clarity worth celebrating. Drawing on her decades of experience, liz ann explains why investors should focus less on trying to predict the future and more on making sound decisions along the way. We explore her unique perspective on the current market environment, including her views on the end of the “great moderation” era and the transition to what she calls the “temperamental era” – a period likely to bring more volatility in both inflation and economic growth. The great moderation is over: here is what comes next | practical lessons from liz ann sonders.

Comments are closed.