Timely Macroeconomic Indicators For 2023 Hoskin Capital

Economic Indicators 2023 | PDF

Economic Indicators 2023 | PDF Amidst the consensus that an economic downturn is soon arriving, this paper puts forth six indicators to predict when the next recession will start, understand when it is occurring as well as confirm when it has ended. With pretty much every bank and economist predicting a recession the question seems to be when, not if. in this paper we examine more timely indicators moving ahead into 2023.

Timely Macroeconomic Indicators For 2023 — Hoskin Capital

Timely Macroeconomic Indicators For 2023 — Hoskin Capital In this article, mckinsey looks at the possible scenarios and outcomes that may occur in 2023 in the wake of shifting macroeconomic conditions. Our analysis reveals that levels of cash have tended to peak around market troughs and shortly before market recoveries. the s&p 500 index surged after both the global financial crisis and covid 19 pandemic, returning at least 40% within three months of each market bottom. This report summarizes— with an emphasis on graphic presentation—the information about cbo’s economic forecast that was published in the budget and economic outlook: 2023 to 2033 (february 2023). Amidst the consensus that an economic downturn is soon arriving, this paper puts forth six indicators to predict when the next recession will start, understand when it is occurring as well as confirm when it has ended.

.png?resize=650,400)

Timely Macroeconomic Indicators For 2023 — Hoskin Capital

Timely Macroeconomic Indicators For 2023 — Hoskin Capital This report summarizes— with an emphasis on graphic presentation—the information about cbo’s economic forecast that was published in the budget and economic outlook: 2023 to 2033 (february 2023). Amidst the consensus that an economic downturn is soon arriving, this paper puts forth six indicators to predict when the next recession will start, understand when it is occurring as well as confirm when it has ended. That said, capital markets will remain vulnerable in 2023 and volatility will likely persist because with inflation at high levels and the fed keeping rates elevated, capital will remain scarce and expensive, and high yield primary credit markets will stay virtually shut down for the time being. Tentative signs in early 2023 that the world economy could achieve a soft landing—with inflation coming down and growth steady—have receded amid stubbornly high inflation and recent financial sector turmoil. With excessive post covid consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, morgan stanley believes global gdp growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022. The past three years have seen a fast pace of economic contraction and recovery, a new ground war in europe, and nuclear warnings from global leaders. in 2023, we will be tested again, but it is in these moments of adversity that we find out what we're truly made of.

.png?format=1500w?resize=650,400)

Bond Indicators For 2023 — Hoskin Capital

Bond Indicators For 2023 — Hoskin Capital That said, capital markets will remain vulnerable in 2023 and volatility will likely persist because with inflation at high levels and the fed keeping rates elevated, capital will remain scarce and expensive, and high yield primary credit markets will stay virtually shut down for the time being. Tentative signs in early 2023 that the world economy could achieve a soft landing—with inflation coming down and growth steady—have receded amid stubbornly high inflation and recent financial sector turmoil. With excessive post covid consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, morgan stanley believes global gdp growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022. The past three years have seen a fast pace of economic contraction and recovery, a new ground war in europe, and nuclear warnings from global leaders. in 2023, we will be tested again, but it is in these moments of adversity that we find out what we're truly made of.

.png?resize=650,400)

Bond Indicators For 2023 — Hoskin Capital

Bond Indicators For 2023 — Hoskin Capital With excessive post covid consumer demand, bloated retail inventories and the battle against inflation continuing to weigh on growth in 2023, morgan stanley believes global gdp growth will top out at just 2.2%, narrowly defying recession, but lower than the 3% growth expected for 2022. The past three years have seen a fast pace of economic contraction and recovery, a new ground war in europe, and nuclear warnings from global leaders. in 2023, we will be tested again, but it is in these moments of adversity that we find out what we're truly made of.

Presents Macroeconomic Indicators From 2019 To 2023.Realized And... | Download Scientific Diagram

Presents Macroeconomic Indicators From 2019 To 2023.Realized And... | Download Scientific Diagram

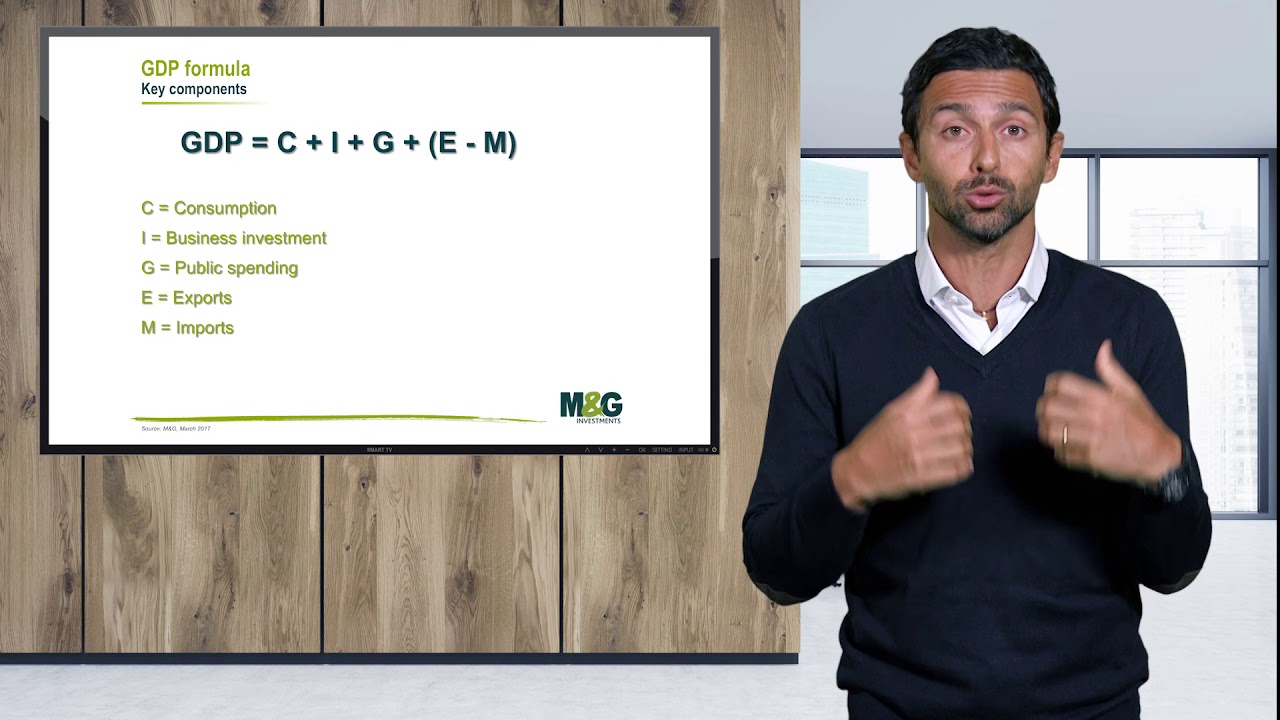

The importance of key macroeconomic indicators

The importance of key macroeconomic indicators

Related image with timely macroeconomic indicators for 2023 hoskin capital

Related image with timely macroeconomic indicators for 2023 hoskin capital

About "Timely Macroeconomic Indicators For 2023 Hoskin Capital"

.png?resize=91,91)

.png?format=1500w?resize=91,91)

.png?resize=91,91)

.png?format=1500w?resize=91,91)

Comments are closed.