Wealth Planning Family Financial Planning

Family Planning - Wealthramp

Family Planning - Wealthramp Home retirement retirement planning i'm a financial adviser: you've built your wealth, now make sure your family keeps it the great wealth transfer is well underway, yet too many families aren't. Whether you have a specific financial goal or are simply looking to create a budget, here’s how to build a comprehensive family financial plan that adapts to your evolving needs.

Family Wealth Planning: A Guide To Preserving Your Legacy - Dominion

Family Wealth Planning: A Guide To Preserving Your Legacy - Dominion Mapping out a financial plan can help families think about how their family's finances can be managed over time. here's some insight on managing your family's money long term. Ultimately, successful family wealth planning transcends mere financial transactions. it involves instilling a legacy of values, responsibility and purpose that can sustain generations. Wealth planning is a holistic approach that goes beyond traditional financial management, aiming to secure the long term financial health of a family while reflecting its core values. this type of planning addresses asset growth, preservation, tax efficiency, and legacy considerations. Family financial planning is the process of managing a family’s financial resources to achieve long term financial stability, security, and goals. it involves creating a strategy for income, expenses, savings, investments, and protection to support the family’s needs and aspirations.

Pin On Financial Preparation

Pin On Financial Preparation Wealth planning is a holistic approach that goes beyond traditional financial management, aiming to secure the long term financial health of a family while reflecting its core values. this type of planning addresses asset growth, preservation, tax efficiency, and legacy considerations. Family financial planning is the process of managing a family’s financial resources to achieve long term financial stability, security, and goals. it involves creating a strategy for income, expenses, savings, investments, and protection to support the family’s needs and aspirations. By charting your family’s financial goals, setting priorities, and establishing a framework for financial decisions, a family financial plan creates a solid foundation for navigating life’s financial complexities. Wealth planning is a crucial aspect of managing financial resources effectively, especially for families looking to secure their financial future. the process involves setting goals, understanding financial situations, and creating a roadmap that aligns with family values. Follow these five steps to start productive conversations with your clients and their families that help them develop an effective plan for managing and preserving their wealth into the future. helping your client develop trust and accountability among family members is key to building intergenerational wealth. For most high net worth individuals with millions of dollars earned and saved over the years, it's not enough to just secure wealth for yourself. the overall goal of making that much money is to build and preserve a legacy for you and your family in the decades to come.

Wealth Planning & Coordination - Matter Family Office

Wealth Planning & Coordination - Matter Family Office By charting your family’s financial goals, setting priorities, and establishing a framework for financial decisions, a family financial plan creates a solid foundation for navigating life’s financial complexities. Wealth planning is a crucial aspect of managing financial resources effectively, especially for families looking to secure their financial future. the process involves setting goals, understanding financial situations, and creating a roadmap that aligns with family values. Follow these five steps to start productive conversations with your clients and their families that help them develop an effective plan for managing and preserving their wealth into the future. helping your client develop trust and accountability among family members is key to building intergenerational wealth. For most high net worth individuals with millions of dollars earned and saved over the years, it's not enough to just secure wealth for yourself. the overall goal of making that much money is to build and preserve a legacy for you and your family in the decades to come.

Financial Planning For Families: Helping To Ensure A Stable Future

Financial Planning For Families: Helping To Ensure A Stable Future Follow these five steps to start productive conversations with your clients and their families that help them develop an effective plan for managing and preserving their wealth into the future. helping your client develop trust and accountability among family members is key to building intergenerational wealth. For most high net worth individuals with millions of dollars earned and saved over the years, it's not enough to just secure wealth for yourself. the overall goal of making that much money is to build and preserve a legacy for you and your family in the decades to come.

Financial Planning And Wealth Management | Family Wealth Advisory Group

Financial Planning And Wealth Management | Family Wealth Advisory Group

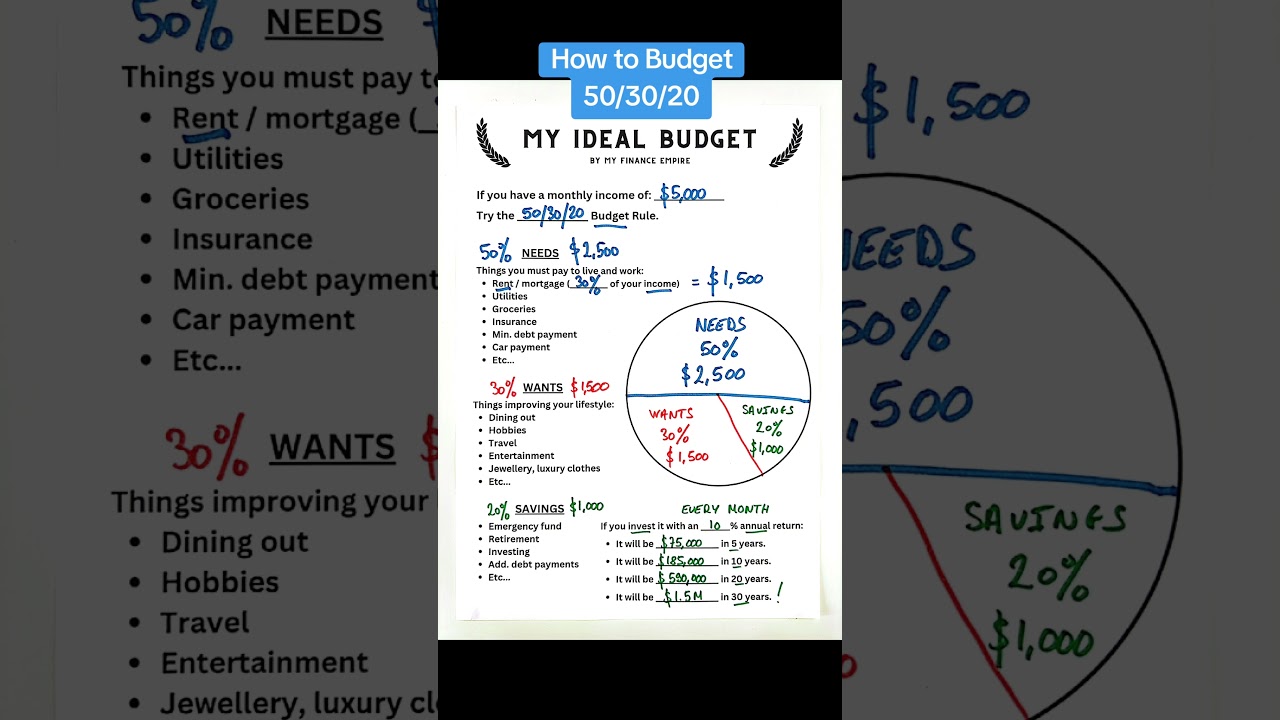

How to Budget Money: The 50/30/20 Rule

How to Budget Money: The 50/30/20 Rule

Related image with wealth planning family financial planning

Related image with wealth planning family financial planning

About "Wealth Planning Family Financial Planning"

Comments are closed.