What Are The Anti Money Laundering Aml And Know Your Customer Kyc Policies For

Anti Money Laundering Act Amla And Know Your Customer Kyc Pdf Money Laundering Customer One key part of these rules is called know your customer (kyc). these rules refer to the process of verifying the identities of customers and assessing potential risks for the company. in this article, we will highlight the core components and meanings of each aml and kyc, and their key differences. what is aml?. Kyc, customer due diligence (cdd) and enhanced due diligence (edd) kyc allows firms to take a risk based approach to aml so that they can both identify their customers, and understand what level of money laundering risk they present.

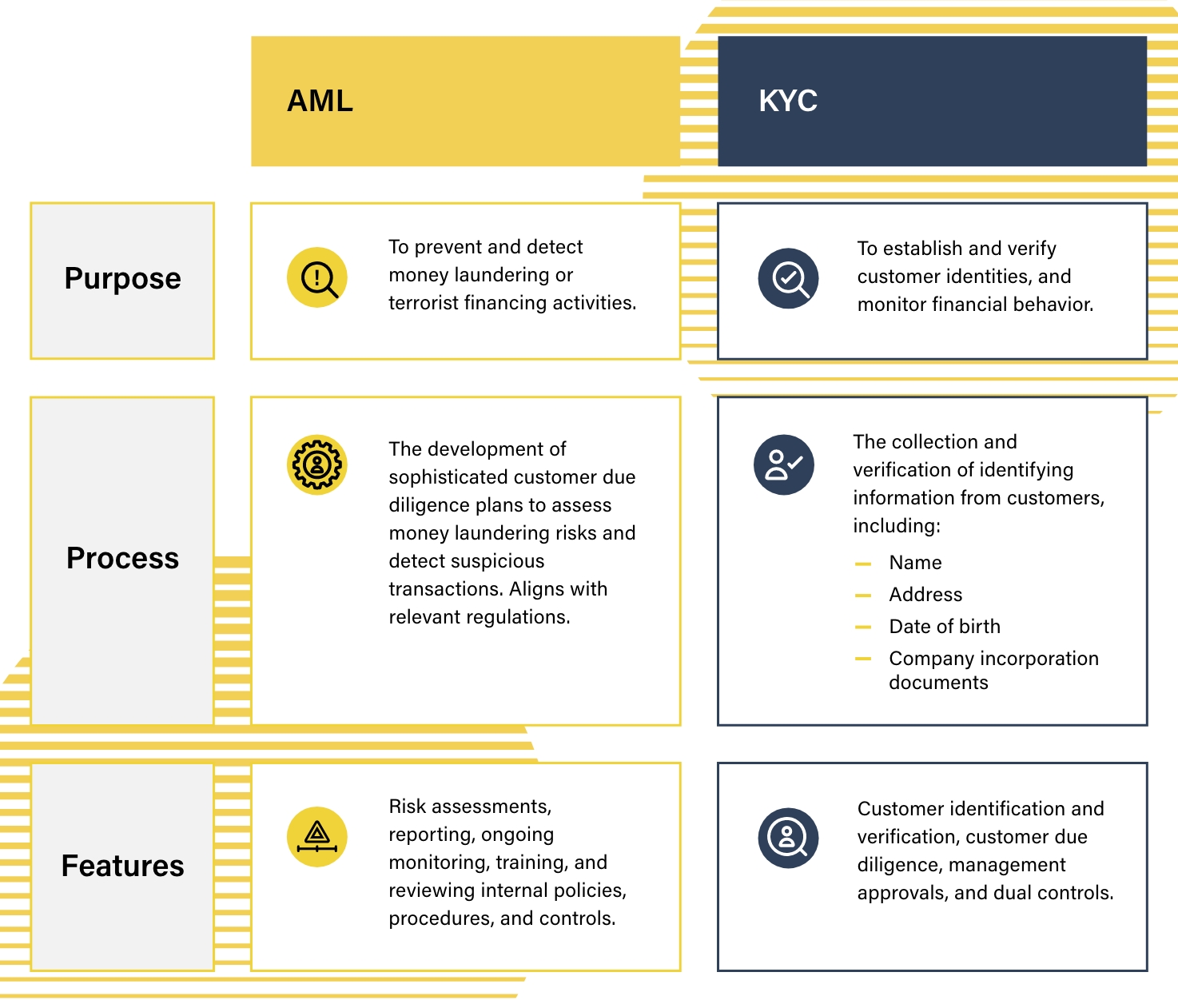

Kyc And Anti Money Laundering Aml Understand The Relation In the financial sector, the acronyms kyc and aml refer to “know your customer” and “anti money laundering” protocols that banks and other financial institutions use to verify customer legitimacy and protect the institution and its customers from fraud, corruption, money laundering, terrorist financing, and other financial crimes. Anti money laundering (aml) and know your customer (kyc) policies are critical components of financial crime prevention and regulatory compliance in the banking and financial services sectors. Kyc (know your customer) is a fundamental component of aml (anti money laundering) regulations, requiring financial institutions to verify the identity, suitability, and risks associated with customers to prevent illegal activities such as money laundering and terrorism financing. Know your customer (kyc) is a critical component of the broader anti money laundering (aml) framework. it refers to the processes organisations use to verify the identity and credentials of their clients, ensuring they are legitimate and not linked to criminal activities.

Financial Institutions Combat Anti Money Laundering Aml With Know Your Customer Kyc Measures Kyc (know your customer) is a fundamental component of aml (anti money laundering) regulations, requiring financial institutions to verify the identity, suitability, and risks associated with customers to prevent illegal activities such as money laundering and terrorism financing. Know your customer (kyc) is a critical component of the broader anti money laundering (aml) framework. it refers to the processes organisations use to verify the identity and credentials of their clients, ensuring they are legitimate and not linked to criminal activities. Know your customer (kyc) and anti money laundering (aml) are two closely related concepts in financial compliance, yet they are not identical. To mitigate financial risks and combat money laundering and other illicit activities, the concepts of know your customer (kyc) and anti money laundering (aml) have become essential. this article explores what kyc aml is and why it is crucial for spvs. Read this guide to understand anti money laundering (aml) and know your customer (kyc). we will discuss more about the differences between aml and kyc, important checks, compliance processes to help you navigate money laundering threats with confidence. what is kyc? kyc or know your customer is an identity verification process for new customers. Anti money laundering (aml) and know your customer (kyc) work helps prevent financial crime and counter terrorism.

What Is Know Your Customer Kyc Anti Money Laundering Aml Master The Crypto Know your customer (kyc) and anti money laundering (aml) are two closely related concepts in financial compliance, yet they are not identical. To mitigate financial risks and combat money laundering and other illicit activities, the concepts of know your customer (kyc) and anti money laundering (aml) have become essential. this article explores what kyc aml is and why it is crucial for spvs. Read this guide to understand anti money laundering (aml) and know your customer (kyc). we will discuss more about the differences between aml and kyc, important checks, compliance processes to help you navigate money laundering threats with confidence. what is kyc? kyc or know your customer is an identity verification process for new customers. Anti money laundering (aml) and know your customer (kyc) work helps prevent financial crime and counter terrorism.

Know Your Customer Kyc Anti Money Laundering Aml Faisal Khan Read this guide to understand anti money laundering (aml) and know your customer (kyc). we will discuss more about the differences between aml and kyc, important checks, compliance processes to help you navigate money laundering threats with confidence. what is kyc? kyc or know your customer is an identity verification process for new customers. Anti money laundering (aml) and know your customer (kyc) work helps prevent financial crime and counter terrorism.

Kyc And Aml What Is The Difference

Comments are closed.