What Is Dollar Cost Averaging Dca Explained How Does Dollar Cost

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. by using dollar cost averaging,. Dollar cost averaging vs lump sum investing consider two investors: one who invests a lump sum of money at once and another who uses dollar cost averaging. in a volatile market, the investor employing dca may end up with a lower average cost per share over time compared to the lump sum investor.

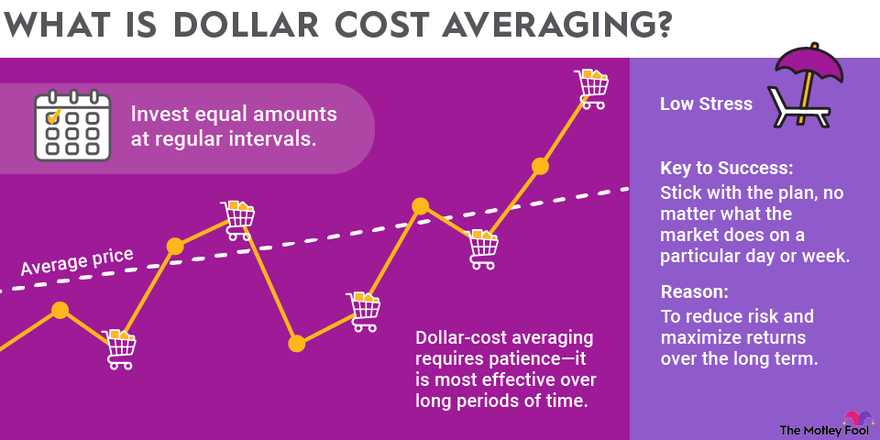

Dollar Cost Averaging Dca Explained With Examples And 44 Off This is called dollar cost averaging and involves investing a fixed amount of money in an automatic fashion to negate the effects of short term price fluctuations. such an investment strategy requires a lot of confidence in the target stock in the long run. That’s where dollar cost averaging comes in. what is dollar cost averaging? it’s an investment strategy where you dedicate a consistent amount of money toward your investments on a regular basis. when you do this, you sometimes buy low and other times, at a high. the idea is that your average price point equalizes over time. Dollar cost averaging is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a security. dollar cost averaging can reduce the overall impact of price volatility and lower the average cost per share. If trying to time your investments perfectly stresses you out, here’s why you need to understand dollar cost averaging.

Dca Or Dollar Cost Averaging Explained For Beginners Dollar cost averaging is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a security. dollar cost averaging can reduce the overall impact of price volatility and lower the average cost per share. If trying to time your investments perfectly stresses you out, here’s why you need to understand dollar cost averaging. Dollar cost averaging is a strategy of investing a defined dollar amount at consistent intervals over time. in theory, it is an investment strategy that lowers the average cost of a security and decreases the potential risk of market volatility. Dollar cost averaging is when you invest equal dollar amounts at regular intervals—like $25 a month—whether the market or your investment is going up or down. want to know if this strategy's right for you? it's helpful to understand the math. here's a hypothetical example say you decide to invest using a dollar cost averaging strategy. • dollar cost averaging (dca) is an investment strategy that helps manage volatility by investing a fixed dollar amount regularly. • dca involves buying securities at regular intervals, regardless of market prices, to avoid trying to time the market. Dollar cost averaging (dca) is an investing strategy where you consistently invest a fixed amount, regardless of market highs or lows. this smooths out volatility over time. instead of timing the market (hard even for pros), you’re building a habit and buying more shares when prices are low, fewer when they’re high.

Comments are closed.