What Is The Maximum Federal Student Loan Amount

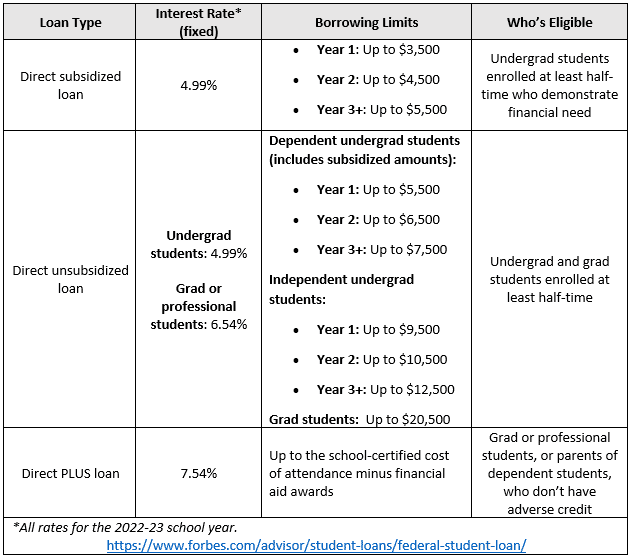

What S The Maximum Student Loan Amount You Can Borrow Story Student Loan Planner Loading. Direct subsidized loans and direct unsubsidized loans have annual loan limits that vary based on the student’s grade level and (for direct unsubsidized loans) dependency status. the annual loan limits are the maximum amounts that a student may receive for an academic year.

Federal Student Loans Repayment Programs Student Loan Advice For federal student loans, your limit depends on whether you can be claimed as a dependent, your current year in school and the type of loan you take out. based on these criteria, undergraduates. What is the maximum you can get in federal student loans? federal student loan limits are designed to encourage responsible borrowing and keep students from taking on too much debt. Federal student loans offer several benefits, but the u.s. government limits how much you can borrow to cover your education costs. here’s what to know about the federal student loan limits for undergraduate and graduate students working toward a degree. As of writing, you can borrow up to $31,000 in federal student loans. but only $23,000 of this total amount can be subsidized loans. independent students don’t appear on anyone else’s tax returns. based on this distinction, you can borrow more than dependent students.

A Guide To Federal Student Loans Marshall Financial Group Federal student loans offer several benefits, but the u.s. government limits how much you can borrow to cover your education costs. here’s what to know about the federal student loan limits for undergraduate and graduate students working toward a degree. As of writing, you can borrow up to $31,000 in federal student loans. but only $23,000 of this total amount can be subsidized loans. independent students don’t appear on anyone else’s tax returns. based on this distinction, you can borrow more than dependent students. The lifetime aggregate federal student loan limit for dependent undergraduate students is $31,000, and no more than $23,000 can be in subsidized loans. for graduate students, the lifetime borrowing limit is $138,500, of which no more than $65,500 can be in subsidized loans. Direct loans are subject to annual and aggregate loan limits. annual limits cap the amount a student may borrow in direct loans during a single academic year and vary by loan type, borrower characteristics, and program and class level. The biggest changes for borrowers include new limits on how much they can borrow in federal student loans, big changes to both current and future borrowers’ repayment options, and changes that will make it harder for borrowers who were harmed by their schools to get debt relief. Independent undergraduates may borrow up to $57,500 in federal student loans. graduate or professional students may borrow up to $138,500 in federal student loans, and certain health profession students may borrow up to $224,000.

Federal Student Loans Definition Types And How To Apply The lifetime aggregate federal student loan limit for dependent undergraduate students is $31,000, and no more than $23,000 can be in subsidized loans. for graduate students, the lifetime borrowing limit is $138,500, of which no more than $65,500 can be in subsidized loans. Direct loans are subject to annual and aggregate loan limits. annual limits cap the amount a student may borrow in direct loans during a single academic year and vary by loan type, borrower characteristics, and program and class level. The biggest changes for borrowers include new limits on how much they can borrow in federal student loans, big changes to both current and future borrowers’ repayment options, and changes that will make it harder for borrowers who were harmed by their schools to get debt relief. Independent undergraduates may borrow up to $57,500 in federal student loans. graduate or professional students may borrow up to $138,500 in federal student loans, and certain health profession students may borrow up to $224,000.

Comments are closed.