What S Next For Boeing Nyse Ba Seeking Alpha

What To Do With Boeing Nyse Ba Seeking Alpha Boeing saw a 20% bounce but faces risks in 2025. read why ba stock could suffer from further dilution and a likely credit downgrade to junk status. Boeing is heavily investing in automation that helps for optimized flow time and eliminating significant labor hours on their production system.

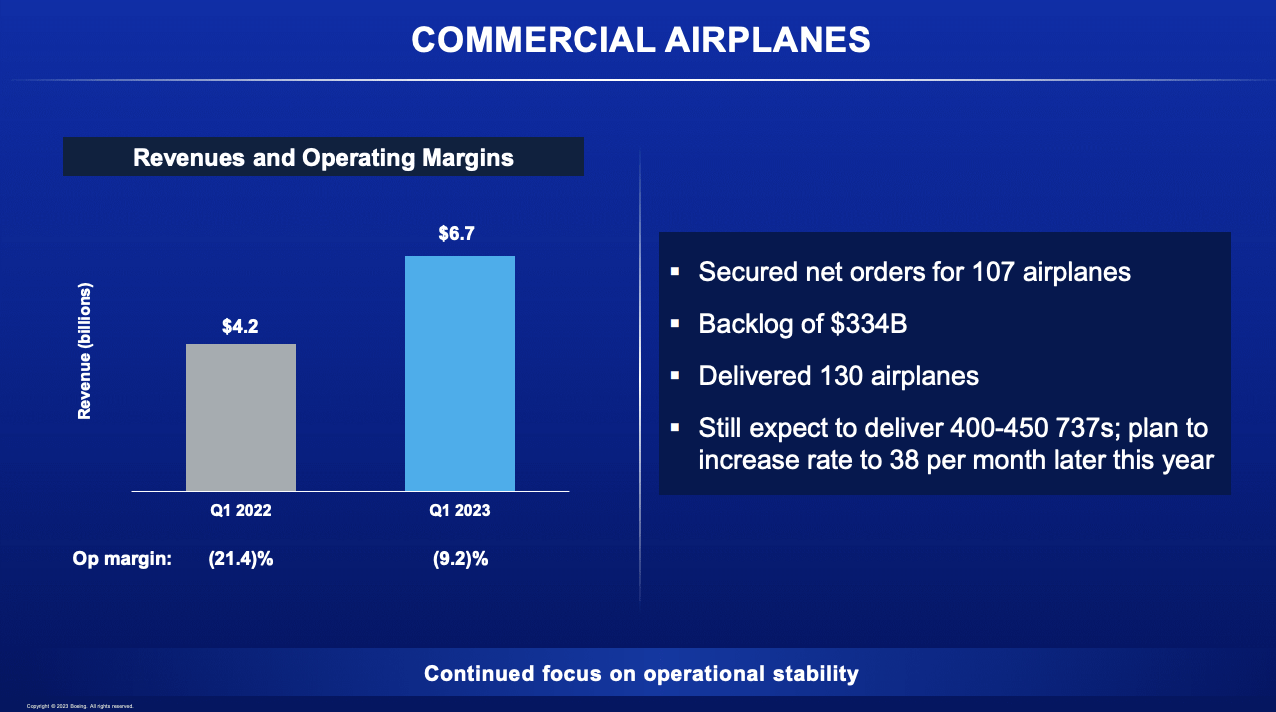

Boeing Stock Impressive Turnaround Nyse Ba Seeking Alpha Seeking alpha analysts discuss what's next for boeing (ba), its competitors and its stock price. read more here. Boeing’s stock delivered an 11.24% return, outperforming the s&p 500’s 9.71% gain since last coverage. projected revenue growth to $85.8 billion by 2025, with a 26.18% rebound expected. Boeing leads in net orders and order value for h1 2025, but airbus is narrowing the gap, especially in single aisle jets. click here to read why ba is a buy. Key triggers for turnaround include ramping up 737 production, backlog conversion, and balance sheet improvements via asset sales and debt reduction. valuation is not deeply discounted, but.

Boeing Stock Impressive Turnaround Nyse Ba Seeking Alpha Boeing leads in net orders and order value for h1 2025, but airbus is narrowing the gap, especially in single aisle jets. click here to read why ba is a buy. Key triggers for turnaround include ramping up 737 production, backlog conversion, and balance sheet improvements via asset sales and debt reduction. valuation is not deeply discounted, but. Boeing (nyse: ba) is set to post second quarter results on tuesday, before markets open. the virginia based company is expected to post eps of $1.31 on revenue of $21.72 billion, implying a. With defense spending ramping up in the u.s. and eu, is now a good time to buy defense stocks, and if so, which ones? seeking alpha analysts weigh in. read more here. According to the 25 analysts' twelve month price targets for boeing, the average price target is $228.90. the highest price target for ba is $280.00, while the lowest price target for ba is $140.00. the average price target represents a forecasted downside of 1.92% from the current price of $233.38.

Comments are closed.